Crown Holdings (NYSE:CCK) Shareholders Booked A 57% Gain In The Last Year

If you want to compound wealth in the stock market, you can do so by buying an index fund. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the Crown Holdings, Inc. (NYSE:CCK) share price is up 57% in the last year, clearly besting than the market return of around -1.1% (not including dividends). So that should have shareholders smiling. The longer term returns have not been as good, with the stock price only 18% higher than it was three years ago.

See our latest analysis for Crown Holdings

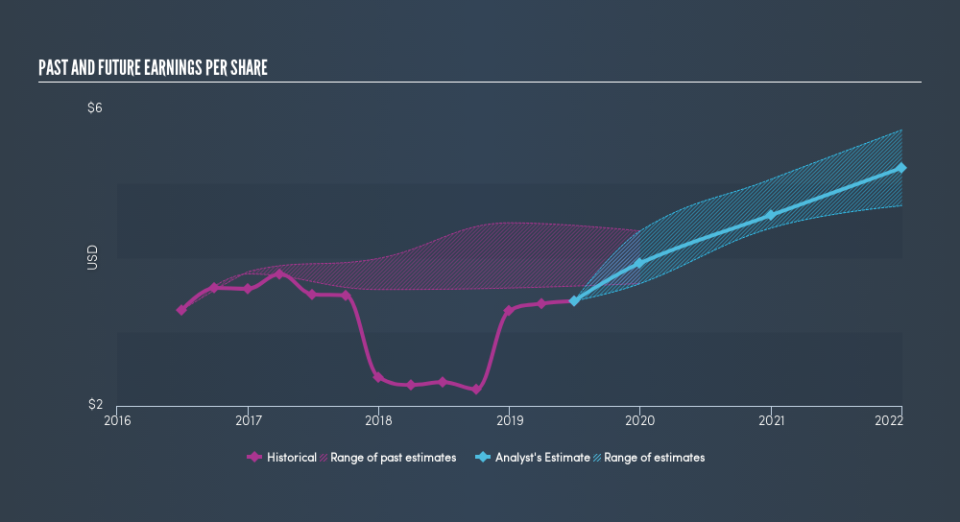

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year Crown Holdings grew its earnings per share (EPS) by 47%. We note that the earnings per share growth isn't far from the share price growth (of 57%). This makes us think the market hasn't really changed its sentiment around the company, in the last year. It makes intuitive sense that the share price and EPS would grow at similar rates.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Crown Holdings has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

It's good to see that Crown Holdings has rewarded shareholders with a total shareholder return of 57% in the last twelve months. That's better than the annualised return of 5.8% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. If you would like to research Crown Holdings in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course Crown Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.