Custodian REIT Plc's (LON:CREI) Stock Financial Prospects Look Bleak: Should Shareholders Be Prepared For A Share Price Correction?

Custodian REIT's (LON:CREI) stock is up by 4.5% over the past three months. However, its weak financial performance indicators makes us a bit doubtful if that trend could continue. Specifically, we decided to study Custodian REIT's ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

See our latest analysis for Custodian REIT

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Custodian REIT is:

0.9% = UK£3.7m ÷ UK£410m (Based on the trailing twelve months to March 2021).

The 'return' is the yearly profit. So, this means that for every £1 of its shareholder's investments, the company generates a profit of £0.01.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Custodian REIT's Earnings Growth And 0.9% ROE

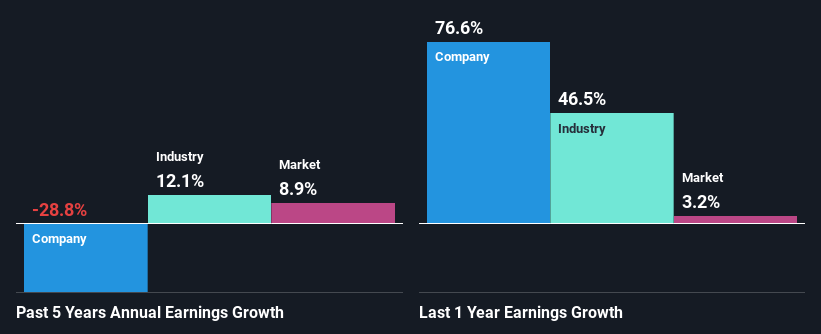

It is hard to argue that Custodian REIT's ROE is much good in and of itself. Even when compared to the industry average of 7.9%, the ROE figure is pretty disappointing. Given the circumstances, the significant decline in net income by 29% seen by Custodian REIT over the last five years is not surprising. However, there could also be other factors causing the earnings to decline. Such as - low earnings retention or poor allocation of capital.

That being said, we compared Custodian REIT's performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 12% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is CREI fairly valued? This infographic on the company's intrinsic value has everything you need to know.

Is Custodian REIT Efficiently Re-investing Its Profits?

Custodian REIT seems to be paying out most of its income as dividends judging by its three-year median payout ratio of 99% (meaning, the company retains only 1.3% of profits). However, this is typical for REITs as they are often required by law to distribute most of their earnings. Accordingly, this likely explains why its earnings have been shrinking.

Moreover, Custodian REIT has been paying dividends for seven years, which is a considerable amount of time, suggesting that management must have perceived that the shareholders prefer consistent dividends even though earnings have been shrinking. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 92% of its profits over the next three years.

Summary

On the whole, Custodian REIT's performance is quite a big let-down. Because the company is not reinvesting much into the business, and given the low ROE, it's not surprising to see the lack or absence of growth in its earnings. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. You can do your own research on Custodian REIT and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.