Danaher's (DHR) Subsidiary Envista Closes IPO, Shares Up

Danaher Corporation’s DHR dental subsidiary, Envista Holdings Corporation, declared that it has successfully closed the initial public offering (IPO) of its common shares, which was announced this June. Envista started trading on the NYSE from Sep 18, 2019.

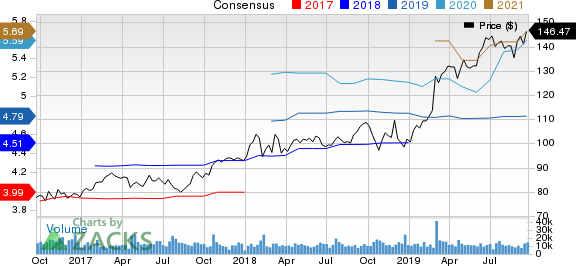

On Sep 20, shares of Danaher increased 0.49%, closing the trading session at $146.47. Meanwhile, Envista’s share price grew 2.75% to $28.77. Notably, Envista’s shares have gained 2.93% since it started trading on the stock exchange.

Inside the Headlines

As noted, Envista’s offering size amounted to 30,783.2 thousand shares, consisting of 26,768 thousand shares sold to the public at $22.00 per share and 4,015.2 thousand shares bought by the underwriters (exercising fully the option vested on them). The purchase price for the underwriters (after adjusting for underwriting discounts) was less than $22.00 for each share.

Net proceeds (after deduction of commissions and underwriting discounts) were $643.4 million. Envista has awarded the net proceeds to Danaher as part payment for the transfer of its dental assets.

Currently, Danaher holds approximately 80.6% shares in Envista.

About Envista

Envista consists of Danaher Dental segment's three operating businesses — Nobel Biocare Systems, Ormco and KaVo Kerr. These businesses specialize in dental equipment, orthodontics, dental implants and consumables. Some notable brands are Nobel Biocare, Kerr, i-CAT, KaVo, Dexis, Pelton & Crane, Metrex, Ormco, Implant Direct, and Orascoptic.

Envista provides services to dentists (more than one million) across as many as 150 countries. It employs 12,000 people.

Zacks Rank, Earnings Estimates and Price Performance

With a market capitalization of approximately $105.1 billion, Danaher currently carries a Zacks Rank #2 (Buy). Over the past 60 days, the Zacks Consensus Estimate for its 2019 earnings remained stable at $4.79, while increased 2.4% to $5.59 for 2020.

Danaher Corporation Price and Consensus

Danaher Corporation price-consensus-chart | Danaher Corporation Quote

In the past three months, shares of the company have gained 3.1% against the industry’s 1.7% decline.

Other Stocks to Consider

Three other top-ranked stocks in the same industry are Federal Signal Corporation FSS, Griffon Corporation (GFF) and United Technologies Corporation UTX. While Federal Signal and Griffon currently sport a Zacks Rank #1 (Strong Buy), United Technologies carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Over the past 60 days, these companies witnessed an upward revision in the current year's earnings estimate. In the last reported quarter, Federal Signal, Griffon and United Technologies delivered a positive earnings surprise of 19.57%, 10.71% and 7.84%, respectively.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Danaher Corporation (DHR) : Free Stock Analysis Report

Federal Signal Corporation (FSS) : Free Stock Analysis Report

United Technologies Corporation (UTX) : Free Stock Analysis Report

Griffon Corporation (GFF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research