Did You Manage To Avoid Ceragon Networks's (NASDAQ:CRNT) Painful 51% Share Price Drop?

This month, we saw the Ceragon Networks Ltd. (NASDAQ:CRNT) up an impressive 46%. But that isn't much consolation to those who have suffered through the declines of the last year. Specifically, the stock price slipped by 51% in that time. It's not that amazing to see a bounce after a drop like that. Arguably, the fall was overdone.

See our latest analysis for Ceragon Networks

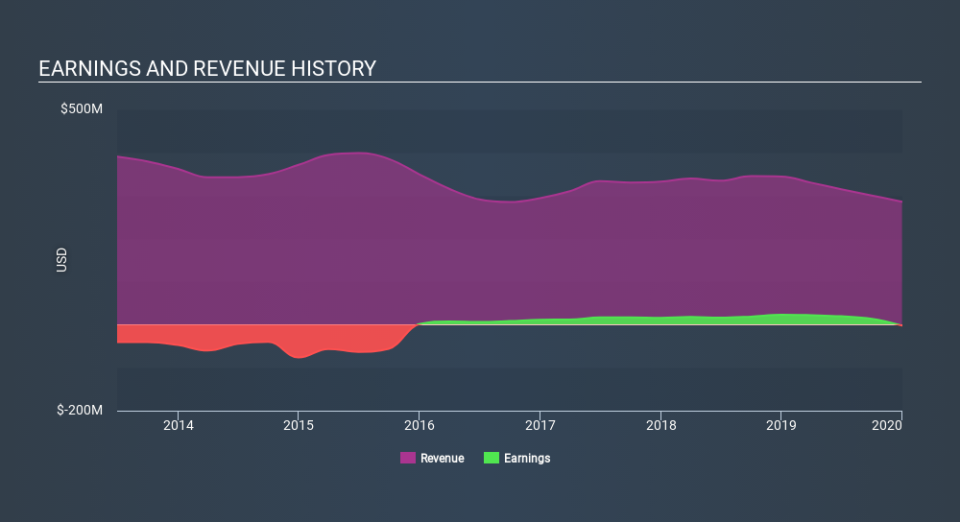

Ceragon Networks wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Ceragon Networks's revenue didn't grow at all in the last year. In fact, it fell 17%. That looks pretty grim, at a glance. In the absence of profits, it's not unreasonable that the share price fell 51%. Having said that, if growth is coming in the future, the stock may have better days ahead. We don't generally like to own companies with falling revenues and no profits, so we're pretty cautious of this one, at the moment.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market lost about 4.0% in the twelve months, Ceragon Networks shareholders did even worse, losing 51%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 8.1% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Ceragon Networks that you should be aware of before investing here.

Of course Ceragon Networks may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.