Dixons Carphone Is the Best Buy of the UK

- By Praveen Chawla

Dixons Carphone PLC (LSE:DC.) (DSITF) is a U.K.-based electronics retailer that has been recommended by guru Francisco Garcia Parames (Trades, Portfolio).

In a letter to clients, he compares the company to Best Buy Co. Inc. (NYSE:BBY) in the U.S., which has been very successful with its omnichannel strategy while fending off online competitors such as Amazon (NASDAQ:AMZN). The company's performance had been overshadowed by its all-stock merger with Carphone Warehouse in 2014, the latter of which proved to have poor profitability because of contractual issues with telecom operators as well as operational issues of integration. According to Parames, the issues associated with the merger have now been resolved and the company has returned to profitability.

Additionally, Brexit continues to weigh on the U.K. market. Accoridng to GuruFocus' Global Stock Market Valuation, the U.K. is about 8% undervalued. So, theoretically, this puts the wind on our backs. Brexit will be increasingly in the rearview mirror as the U.K. and Europe recover from the pandemic.

Dixons balance sheet is in excellent shape with low long-term debt of 70 million pounds ($95.5 million). It maintains a negative working capital, with inventory mostly funded by vendors via accounts payable.

Chart 1 - Balance sheet (click for larger version).

The company has had solid operating and free cash flows and noted in its latest semi-annual report that it has returned to profitability.

Chart 2 - Net income and cash flow

The company's free cash flow and net income is variable from year to year, so it is difficult to value the company using traditional discounted cash flow techniques. To handle such situations, GuruFocus has designed the projected FCF method to value such companies. This method indicates the stock is currently selling for less than one-third of its projected value.

Chart 3 - Projected FCF value

Conclusion

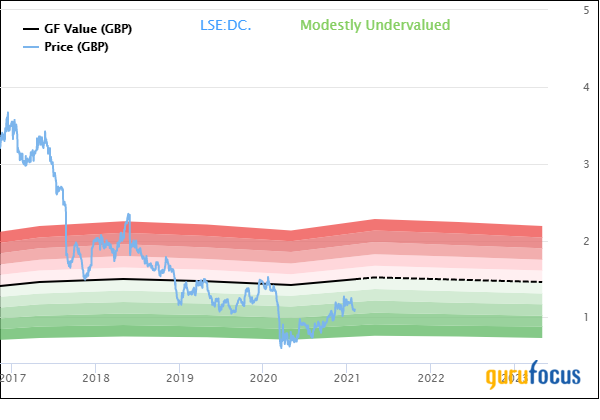

According to GuruFocus, Dixons Carphone is only modestly undervalued.

My overall impression is that Dixons Carphone is a strong value pick. The risk of permanent capital loss is low as the balance sheet is solid with little debt. The company has a good position in the U.K. and the Scandinavian market and is generating solid cash flow. If it manages to replicate Best Buy's omnichannel formula in Europe, it could be a long-term winner.

Disclosure: The author owns Dixons Carphone PLC shares.

Read more here:

Ingles Market Is Having a Nice Pandemic

Goodyear: A Good Opportunity for Value Investors

A Checkup on Veritiv

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.