Does China Maple Leaf Educational Systems (HKG:1317) Have A Healthy Balance Sheet?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, China Maple Leaf Educational Systems Limited (HKG:1317) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for China Maple Leaf Educational Systems

What Is China Maple Leaf Educational Systems's Net Debt?

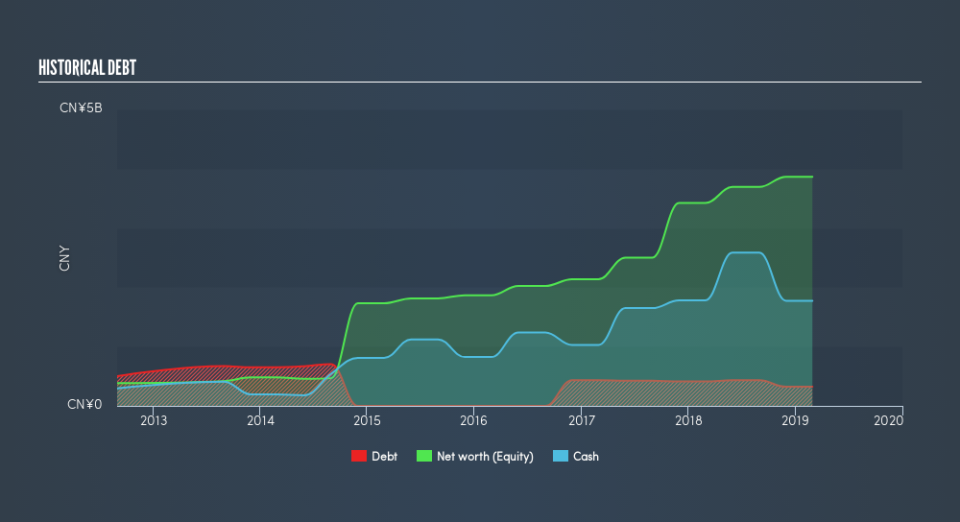

The image below, which you can click on for greater detail, shows that China Maple Leaf Educational Systems had debt of CN¥322.4m at the end of February 2019, a reduction from CN¥411.8m over a year. But it also has CN¥1.77b in cash to offset that, meaning it has CN¥1.45b net cash.

How Strong Is China Maple Leaf Educational Systems's Balance Sheet?

According to the last reported balance sheet, China Maple Leaf Educational Systems had liabilities of CN¥1.13b due within 12 months, and liabilities of CN¥242.4m due beyond 12 months. Offsetting this, it had CN¥1.77b in cash and CN¥72.0m in receivables that were due within 12 months. So it can boast CN¥469.4m more liquid assets than total liabilities.

This short term liquidity is a sign that China Maple Leaf Educational Systems could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, China Maple Leaf Educational Systems boasts net cash, so it's fair to say it does not have a heavy debt load!

And we also note warmly that China Maple Leaf Educational Systems grew its EBIT by 10% last year, making its debt load easier to handle. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine China Maple Leaf Educational Systems's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While China Maple Leaf Educational Systems has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, China Maple Leaf Educational Systems actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing up

While it is always sensible to investigate a company's debt, in this case China Maple Leaf Educational Systems has CN¥1.5b in net cash and a decent-looking balance sheet. The cherry on top was that in converted 104% of that EBIT to free cash flow, bringing in CN¥545m. So is China Maple Leaf Educational Systems's debt a risk? It doesn't seem so to us. Another factor that would give us confidence in China Maple Leaf Educational Systems would be if insiders have been buying shares: if you're conscious of that signal too, you can find out instantly by clicking this link.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.