Does First Capital Inc’s (FCAP) PE Ratio Signal A Buying Opportunity?

First Capital Inc (NASDAQ:FCAP) trades with a trailing P/E of 16.8x, which is lower than the industry average of 23.6x. Although some investors may jump to the conclusion that this is a great buying opportunity, understanding the assumptions behind the P/E ratio might change your mind. Today, I will break down what the P/E ratio is, how to interpret it and what to watch out for. Check out our latest analysis for First Capital

What you need to know about the P/E ratio

The P/E ratio is a popular ratio used in relative valuation since earnings power is a key driver of investment value. By comparing a stock’s price per share to its earnings per share, we are able to see how much investors are paying for each dollar of the company’s earnings.

Formula

Price-Earnings Ratio = Price per share ÷ Earnings per share

P/E Calculation for FCAP

Price per share = 36.57

Earnings per share = 2.173

∴ Price-Earnings Ratio = 36.57 ÷ 2.173 = 16.8x

The P/E ratio itself doesn’t tell you a lot; however, it becomes very insightful when you compare it with other similar companies. We preferably want to compare the stock’s P/E ratio to the average of companies that have similar features to FCAP, such as capital structure and profitability. A common peer group is companies that exist in the same industry, which is what I use below. Since similar companies should technically have similar P/E ratios, we can very quickly come to some conclusions about the stock if the ratios differ.

Since FCAP's P/E of 16.8x is lower than its industry peers (23.6x), it means that investors are paying less than they should for each dollar of FCAP's earnings. Therefore, according to this analysis, FCAP is an under-priced stock.

Assumptions to watch out for

Before you jump to the conclusion that FCAP represents the perfect buying opportunity, it is important to realise that our conclusion rests on two important assertions. The first is that our peer group actually contains companies that are similar to FCAP. If this isn’t the case, the difference in P/E could be due to some other factors. For example, if you accidentally compared higher growth firms with FCAP, then FCAP’s P/E would naturally be lower since investors would reward its peers’ higher growth with a higher price. Alternatively, if you inadvertently compared less risky firms with FCAP, FCAP’s P/E would again be lower since investors would reward its peers’ lower risk with a higher price as well. The second assumption that must hold true is that the stocks we are comparing FCAP to are fairly valued by the market. If this does not hold, there is a possibility that FCAP’s P/E is lower because firms in our peer group are being overvalued by the market.

What this means for you:

Are you a shareholder? You may have already conducted fundamental analysis on the stock as a shareholder, so its current undervaluation could signal a good buying opportunity to increase your exposure to FCAP. Now that you understand the ins and outs of the PE metric, you should know to bear in mind its limitations before you make an investment decision.

Are you a potential investor? If FCAP has been on your watch list for a while, it is best you also consider its intrinsic valuation. Looking at PE on its own will not give you the full picture of the stock as an investment, so I suggest you should also look at other relative valuation metrics like EV/EBITDA or PEG.

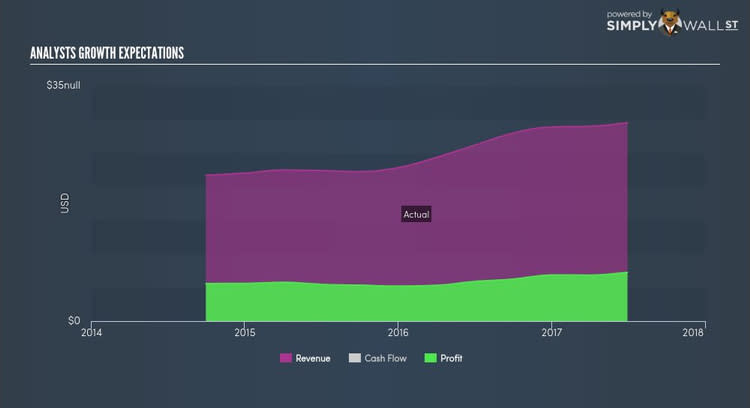

PE is one aspect of your portfolio construction to consider when holding or entering into a stock. But it is certainly not the only factor. Take a look at our most recent infographic report on First Capital for a more in-depth analysis of the stock to help you make a well-informed investment decision. Since we know a limitation of PE is it doesn't properly account for growth, you can use our free platform to see my list of stocks with a high growth potential and see if their PE is still reasonable.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.