Dow 30 Stock Roundup: Coca-Cola Buys Costa, DowDuPont Earnings Impress

The index remained weighed down by trade tensions during a holiday-shortened week. Even as the Trump administration inked a trade deal with Mexico, a similar agreement with Canada remained elusive. Trump also remained poised to impose fresh tariffs worth $200 billion on China. Economic data remained impressive with the ISM manufacturing index, jumping to a 14-year high.

Last Week’s Performance

The index lost 0.1% last Friday after trade-related negotiations between the United States and Canada remained inconclusive. Lingering tariff-related conflicts between the United States and China also made investors shaky.

The index has gained 0.7% over last week, marking its third straight weekly gain. During the week, the Dow reached its psychologically important 26,000 level, but failed to maintain that mark.

U.S. stocks ended in the green in the first three trading days buoyed by strong second-quarter GDP data and robust consumer confidence numbers. Moreover, a new bilateral deal between the United States and Mexico also boosted market sentiment.

However, during the last two days, markets ended mostly in the red following reports that the United States will impose fresh tariffs worth $200 billion on China.

For the Dow, this year’s August was the best one since 2014. The Dow 30 returned 2.2% in August to investors, its second straight monthly gain. Except a marginal loss in June, the blue-chip index has provided positive returns in four out of last five months.

Wall Street’s robust performance in August was buoyed by strong second-quarter 2018 earnings results and solid macro-economic data. However, lingering trade related concerns, especially between the United States and China, and geopolitical conflicts in Turkey and Iran continue to kill investors’ risk appetite.

The Dow This Week

Markets were closed on Monday for the Labor Day holiday. The index declined 0.1% on Tuesday as trade-related conflicts between the United States and its two largest trading partners – China and Canada – flared up again.

Over the weekend, Trump threatened to eliminate Canada from the new NAFTA pact in a tweet. Trump also warned the U.S. Congress not to intervene in the Canada deal. The ISM manufacturing index jumped to a 14-year high in August.

The index gained 0.1% on Wednesday following a sharp decline in major technology stocks. The technology sector witnessed its worst single-day decline in more than a month after top executives of leading social media companies were asked to testify before U.S. lawmakers.

The index erased early losses to gain 0.1% on Thursday. Trade-war concerns, fear of contagion from certain emerging markets and softness in tech stocks rattled investor confidence. Jobless claims plummeted to their lowest level since 1969. Service sector gauges came in mixed for the month of August.

Components Moving the Index

The Coca-Cola Company KO has entered into an agreement with Whitbread PLC, the parent of the London-based coffee chain — Costa, for £3.9 billion (nearly $5.1 billion). As part of the deal, Coca-Cola will acquire all outstanding shares of Costa from a wholly owned subsidiary of Whitbread.

The acquisition offers Zacks Rank #3 (Hold) Coca-Cola a strong coffee platform, with presence across Europe, the Asia Pacific, the Middle East and Africa, and the potential to expand further. Costa will provide Coca-Cola with its expertise in coffee supply chain, including sourcing, vending and distribution.

Further, Costa’s leading position in the United Kingdom and a fast-growing footprint in China are added advantages. (Read: Coca-Cola to Expand in Coffee Space With Costa Buyout)

DowDuPont Inc. DWDP recorded earnings (on a reported basis) from continuing operations of 76 cents per share for second-quarter 2018 compared with $1.07 it logged in the comparable quarter a year ago.

Barring one-time items, earnings came in at $1.37 per share for the quarter, which topped the Zacks Consensus Estimate of $1.33. Zacks Rank #3 DowDuPont raked in net sales of $24,245 million for the reported quarter, up 17% from the year-ago adjusted sales. It also surpassed the Zacks Consensus Estimate of $23,671 million.

DowDuPont expects net sales in the third quarter to increase more than 10% and operating EBITDA to rise more than 12% on a year-over-year basis. (Read: DowDuPont Earnings, Revenues Trounce Estimates in Q2)

The Boeing Company BA recently won a contract for supplying the design, development, fabrication, test, verification, certification, delivery, and support of four MQ-25A unmanned air vehicles (UAV). Majority of the work related to the deal will be carried out in Louis, MO.

Valued at $805.3 million, the contract was awarded by the Naval Air Systems Command, Patuxent River, MD. Per the terms of the agreement, Zacks Rank #3 Boeing will also integrate the UAVs into the carrier air wing to offer an initial operational capability to the Navy. (Read: Boeing Secures $805M Deal to Build MQ-25A UAV for US Navy)

UnitedHealth Group Incorporated’s UNH health service business, branded as Optum, and private equity firm, Summit Partners, are together going to acquire a controlling interest in Tacoma-based Sound Physicians. Total value of this transaction is $2.2 billion.

With this deal, the company would be able to expand its OptumHealth portfolio as well as continue its focus on care delivery, which has been really successful over the past few quarters through provider acquisitions. OptumHealth’s care delivery services account for around two-thirds of the company’s projected revenues in 2018. The stock has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Pfizer, Inc. PFE announced that it has received Breakthrough Therapy designation for its pipeline candidate, PF-06651600 from the FDA. The candidate is being developed for alopecia areata, a chronic autoimmune skin disease that causes hair loss on the scalp, face, or body. Pfizer has a Zacks Rank #3.

The designation was granted based on positive data from a phase II study on PF-06651600, an oral JAK3 inhibitor for the said indication. Data from this mid-stage study is expected to be presented at the 2018 27th European Academy of Dermatology and Venerology (EADV) Congress in Paris later this month. (Read: Pfizer's Skin Disease Drug Gets Breakthrough Therapy Status)

Exxon Mobil Corporation XOM continues to gain from its holding in some of the most prolific upstream assets globally, particularly the Stabroek Block. The block’s exploration potential was proven again with the ninth discovery at the Hammerhead-1 well, offshore Guyana. Exxon Mobil has a Zacks Rank #3.

Hammerhead-1 well also represents the fifth find on the Stabroek Block in the past year. Located about 13 miles southwest of the Liza-1 well, the Hammerhead-1 encountered about 197 feet (60 meters) of superior, oil-bearing sandstone reservoir. (Read: Exxon Discovers Oil in Hammerhead -1 Exploration Well)

Merck & Co., Inc. MRK announced that the FDA has approved two new medicines for the deadly HIV-1 disease containing its investigational medicine, doravirine. Delstrigo and Pifeltro were approved to treat adult patients, who have not undergone any antiretroviral treatment. Merck has a Zacks Rank #3.

Delstrigo is a once-daily triple combination regimen consisting of its non-nucleoside reverse transcriptase inhibitor (“NNRTI”), doravirine (100 mg), lamivudine (3TC, 300 mg) and tenofovir disoproxil fumarate (TDF, 300 mg). Pifeltro (doravirine), a once-daily single tablet should be administered in combination with other antiretroviral medicines. (Read: Merck Receives FDA Approval for Two HIV Medicines)

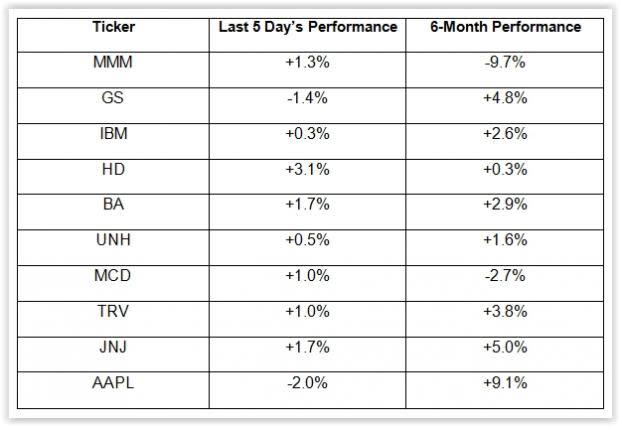

Performance of the Top 10 Dow Companies

The table given below shows the price movements of the 10 largest components of the Dow, which is a price-weighted index, over the last five days and during the last six months. Over the last five trading days, the Dow has gained 0.2%.

Next Week’s Outlook

As we head into September, trade tensions continue to weigh on the markets. A NAFTA replacement deal with Canada remains elusive despite the signing of a similar agreement with Mexico. Meanwhile, the Trump administration remains poised to impose further tariffs on China.

Economic data is the only bright spot for investors as we head into next week. If crucial reports like Friday’s jobs numbers remain encouraging, markets could return to their winning ways next week.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

The Boeing Company (BA) : Free Stock Analysis Report

Coca-Cola Company (The) (KO) : Free Stock Analysis Report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Dow Chemical Company (The) (DWDP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research