What Are The Drivers Of Explor Resources Inc’s (TSXV:EXS) Risks?

If you are looking to invest in Explor Resources Inc’s (TSXV:EXS), or currently own the stock, then you need to understand its beta in order to understand how it can affect the risk of your portfolio. Generally, an investor should consider two types of risk that impact the market value of EXS. The first risk to think about is company-specific, which can be diversified away by investing in other companies in order to lower your exposure to one particular stock. The other type of risk, which cannot be diversified away, is market risk. Every stock in the market is exposed to this risk, which arises from macroeconomic factors such as economic growth and geo-political tussles just to name a few.

Not every stock is exposed to the same level of market risk. A popular measure of market risk for a stock is its beta, and the market as a whole represents a beta value of one. Any stock with a beta of greater than one is considered more volatile than the market, and those with a beta less than one is generally less volatile.

See our latest analysis for EXS

What is EXS’s market risk?

Explor Resources has a beta of 1.42, which means that the percentage change in its stock value will be higher than the entire market in times of booms and busts. A high level of beta means investors face higher risk associated with potential gains and losses driven by market movements. Based on this beta value, EXS can help magnify your portfolio return, especially if it is predominantly made up of low-beta stocks. If the market is going up, a higher exposure to the upside from a high-beta stock can push up your portfolio return.

How does EXS's size and industry impact its risk?

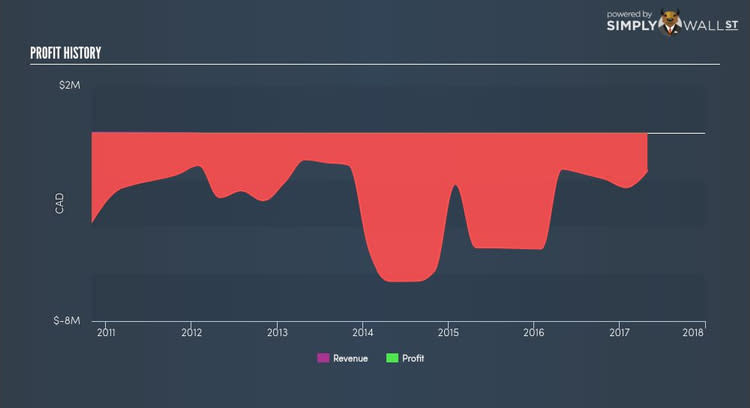

EXS, with its market capitalisation of CAD $11.37M, is a small-cap stock, which generally have higher beta than similar companies of larger size. Furthermore, the company operates in the materials industry, which has been found to have high sensitivity to market-wide shocks. Therefore, investors may expect high beta associated with small companies, as well as those operating in the X industry, relative to those more well-established firms in a more defensive industry. This is consistent with EXS’s individual beta value we discussed above. Next, we will examine the fundamental factors which can cause cyclicality in the stock.

Is EXS's cost structure indicative of a high beta?

During times of economic downturn, low demand may cause companies to readjust production of their goods and services. It is more difficult for companies to lower their cost, if the majority of these costs are generated by fixed assets. Therefore, this is a type of risk which is associated with higher beta. I test EXS’s ratio of fixed assets to total assets in order to determine how high the risk is associated with this type of constraint. With a fixed-assets-to-total-assets ratio of greater than 30%, EXS appears to be a company that invests a large amount of capital in assets that are hard to scale down on short-notice. Thus, we can expect EXS to be more volatile in the face of market movements, relative to its peers of similar size but with a lower proportion of fixed assets on their books. This is consistent with is current beta value which also indicates high volatility.

What this means for you:

Are you a shareholder? You may reap the gains of EXS's returns in times of an economic boom. Though the business does have higher fixed cost than what is considered safe, during times of growth, consumer demand may be high enough to not warrant immediate concerns. However, during a downturn, a more defensive stock can cushion the impact of this risk.

Are you a potential investor? I recommend that you look into EXS's fundamental factors such as its current valuation and financial health as well. Take into account your portfolio sensitivity to the market before you invest in the stock, as well as where we are in the current economic cycle. EXS may be a great investment during times of economic growth.

Beta is one aspect of your portfolio construction to consider when holding or entering into a stock. But it is certainly not the only factor. Take a look at our most recent infographic report on Explor Resources for a more in-depth analysis of the stock to help you make a well-informed investment decision. But if you are not interested in Explor Resources anymore, you can use our free platform to see my list of over 50 other stocks with a high growth potential.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.