Echo Global (ECHO) to Report Q2 Earnings: What's in Store?

Echo Global Logistics ECHO is scheduled to report second-quarter 2021 results on Jul 28, after market close.

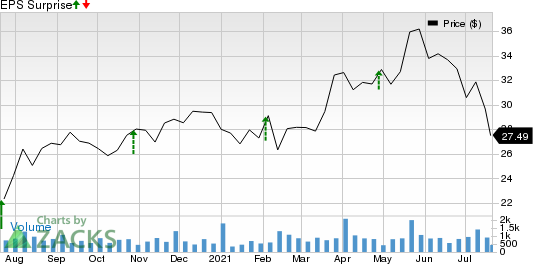

The company’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters by 47%, on average.

Echo Global Logistics, Inc. Price and EPS Surprise

Echo Global Logistics, Inc. price-eps-surprise | Echo Global Logistics, Inc. Quote

The Zacks Consensus Estimate for second-quarter earnings per share has been stable at 58 cents over the past 60 days.

Against this backdrop, let’s discuss the factors that might have impacted Echo Global’s performance in the June quarter.

We expect Echo Global’s performance in the to-be-reported quarter to have been aided by the expansion in truckload and LTL (less-than-truckload) volumes as economic activities gather pace with the easing of restrictions and ramped up vaccination programs.

Revenues at both segments, namely Managed Transportation and Transactional are likely to have increased in the June quarter from the year-ago reported levels. This, in turn, might have boosted the company’s top line.

The Zacks Consensus Estimate for managed transportation revenues in the June quarter is currently pegged at $175 million, indicating an increase of 48.3% from the second-quarter 2020 actuals. The Zacks Consensus Estimate for June-quarter transactional revenues currently stands at $604 million, implying an increase of 52.1% from the second-quarter 2020 actuals.

Escalated general and administrative expenses in the to-be-reported quarter are likely to have dented the bottom-line performance in the same period. The uptick in costs might reflect higher headcount, and increased technology operations and sales in the upcoming results.

What Does the Zacks Model Unveil?

The proven Zacks model does not predict an earnings beat for Echo Global this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of a positive surprise, which is not the case here as shown below. You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings ESP: Echo Global has an Earnings ESP of -3.79%. The Most Accurate Estimate is currently pegged at 56 cents, 2 cents lower than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Echo Global carries a Zacks Rank #2, currently.

Highlights of Q1

Echo Global’s first-quarter earnings per share (excluding 8 cents from non-recurring items) of 46 cents beat the Zacks Consensus Estimate of 33 cents. The bottom line surged 411.1% year over year. Total revenues of $800.8 million surpassed the Zacks Consensus Estimate of $724.4 million.

Stocks to Consider

Investors interested in the broader Transportation sector may consider American Airlines AAL, Herc Holdings HRI and Alaska Air Group ALK as these stocks possess the right combination of elements to beat on earnings this reporting cycle.

American Airlines has an Earnings ESP of +4.40% and is Zacks #3 Ranked, presently. The company will release second-quarter 2021 results on Jul 22.

Herc Holdings has an Earnings ESP of +1.85% and a Zacks Rank of 2 at present. The company will release second-quarter 2021 results on Jul 22.

Alaska Air has an Earnings ESP of +23.77% and is currently a #3 Ranked player. The company will release second-quarter 2021 results on Jul 22.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Airlines Group Inc. (AAL) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

Echo Global Logistics, Inc. (ECHO) : Free Stock Analysis Report

Herc Holdings Inc. (HRI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research