Ecolab (ECL) Q4 Earnings & Revenues Beat Mark, Margins Down

Ecolab Inc. ECL reported fourth-quarter 2021 adjusted earnings per share (“EPS”) of $1.28, up 4.1% year over year. The bottom line exceeded the Zacks Consensus Estimate by 0.8%.

GAAP EPS for the quarter was $1.04, flat compared with the year-earlier figure.

Full-year adjusted EPS was $4.69, reflecting a 16.7% increase from the year-ago period. The metric was in line with the Zacks Consensus Estimate.

Revenue Details

Revenues grossed $3.36 billion in the reported quarter, up 9.8% year over year. The metric surpassed the Zacks Consensus Estimate by 5.3%.

Ecolab’s fixed currency sales increased 10% and acquisition-adjusted fixed currency sales increased 9% from the prior-year period’s level.

The year-over-year uptick in the fourth-quarter top line was driven by double-digit gains in Ecolab’s Institutional & Specialty, and Other segments, and continued strong growth in the company’s Industrial segment. The company also recorded substantial volume and pricing momentum, largely offset by significant cost increases of raw materials and freight.

Full-year revenues were $12.73 billion, reflecting a 7.9% improvement from the year-ago period. The metric topped the Zacks Consensus Estimate by 0.9%.

Segmental Analysis

The Global Industrial segment’s fixed currency sales of $1.69 billion reflect 7.9% reported growth whereas acquisition-adjusted fixed currency sales inched up 7% year over year. The improvement in the acquisition-adjusted fixed currency sales was driven by strong growth in Water, Paper and Downstream, led by new business wins and accelerated pricing, along with good gains in Food & Beverage.

The Global Institutional & Specialty arm’s fixed currency sales of $1.06 billion reflect reported growth of 18.9%, whereas acquisition-adjusted fixed currency sales surged 19% year over year. The improvement in the Institutional division reflect improved volume, further good new business wins, gains from Ecolab Science Certified programs, and new innovation and pricing despite a stalled recovery in restaurant and lodging activity compared with the third quarter due to COVID-related impacts. Specialty sales increased modestly as strong quickservice sales more than offset lower food retail sales, in part due to customer staffing shortages.

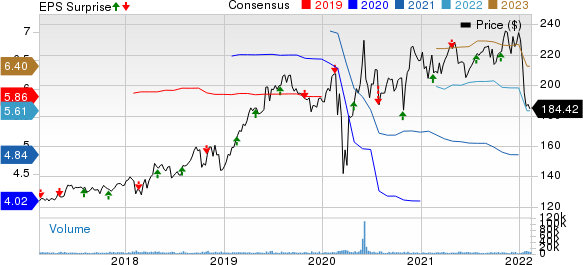

Ecolab Inc. Price, Consensus and EPS Surprise

Ecolab Inc. price-consensus-eps-surprise-chart | Ecolab Inc. Quote

The Global Healthcare and Life Sciences’ fixed currency sales of $308 million declined 6% while acquisition-adjusted fixed currency sales fell 13% year over year.

The Other segment’s fixed currency sales of $322.7 million improved 12.8% on a reported basis while acquisition-adjusted fixed currency sales jumped 13% year over year. The uptick in acquisition-adjusted fixed currency sales was led by strong growth across all divisions, including Pest Elimination, Textile Care and Colloidal Technologies businesses.

Margin Analysis

In the quarter under review, Ecolab’s gross profit improved 2.8% to $1.32 billion. Gross margin contracted 264 basis points (bps) to 39.3%.

Selling, general and administrative expenses rose 7.2% to $867.9 million, year over year.

Adjusted operating profit totaled $453.6 million, declining 4.6% from the prior-year quarter’s level. Adjusted operating margin in the quarter also contracted 203 bps to 13.5%.

Financial Position

Ecolab exited full-year 2021 with cash and cash equivalents of $359.9 million compared with $1.26 billion at the end of 2020. Total debt at the end of 2021 was $8.76 billion compared with $6.69 billion at the end of 2020.

Meanwhile, Ecolab has a consistent dividend-paying history, with five-year annualized dividend growth being 6.38%.

Guidance

Ecolab has not initiated either quarterly or full-year 2022 outlook due to continued uncertainty surrounding the COVID-19 pandemic besides the full scope of its impact on the global economy and the duration of the same.

However, the company expects the first quarter to register healthy sales growth and an almost flat year-over-year EPS comparison impacted by continued high raw material and freight costs.

For full-year 2022, Ecolab believes its sales, pricing and cost efficiency actions will enable it to deliver continued strong sales gains with adjusted EPS growth reaching low-teens levels, assuming once again that inflation and supply constraints ease as the year progresses. The company also continues to expect that the impact of Purolite, including 26 cents per share of transaction-related amortization, will be neutral to 2022 adjusted EPS.

Our Take

Ecolab exited the fourth quarter with better-than-expected results. However, the company faced significant COVID-related effects on broad business activities and a near doubling of delivered product cost inflation (which includes raw materials and freight) and supply constraints, which weighed on its top-line growth. Continued weak performance in the Global Healthcare and Life Sciences business segment in the quarter under review is concerning. Contraction of both margins does not bode well as well. The fact that it is yet to provide any financial outlook raises our apprehensions.

Nonetheless, the company registered robust year-over-year upticks in both the top and bottom lines, along with solid performances across the majority of its segments. Strong volume and pricing momentum are also encouraging. Ecolab’s new business wins, innovation pipelines and the new focus areas (like life sciences, data centers and animal health) are well-positioned to drive growth and its global leadership. The company’s digital capabilities are also continuing to broaden, develop and add competitive advantages, which are encouraging.

Zacks Rank and Stocks to Consider

Ecolab currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the broader medical space that have announced quarterly results are GlaxoSmithKline plc GSK, Molina Healthcare, Inc. MOH and Bio-Rad Laboratories, Inc. BIO.

GlaxoSmithKline, carrying a Zacks Rank #2 (Buy), reported fourth-quarter 2021 adjusted earnings of 69 cents per American depositary share, which beat the Zacks Consensus Estimate by 9.5%. Revenues of $13 billion outpaced the consensus mark by 3%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

GlaxoSmithKline has an estimated long-term growth rate of 5.6%. GSK's earnings surpassed estimates in three of the trailing four quarters, the average surprise being 20.5%.

Molina Healthcare reported fourth-quarter 2021 adjusted EPS of $2.88, which surpassed the Zacks Consensus Estimate by 2.1%. Fourth-quarter revenues of $7.41 billion outpaced the Zacks Consensus Estimate by 3.9%. It currently carries a Zacks Rank #2.

Molina Healthcare has an estimated long-term growth rate of 18.8%. MOH's earnings surpassed estimates in three of the trailing four quarters, the average surprise being 5%.

Bio-Rad reported fourth-quarter 2021 adjusted EPS of $3.21, which surpassed the Zacks Consensus Estimate by 11.9%. Fourth-quarter revenues of $732.8 million outpaced the Zacks Consensus Estimate by 0.5%. It currently has a Zacks Rank #2.

Bio-Rad has an earnings yield of 2.3%, which compares favorably with the industry’s negative yield. BIO's earnings surpassed estimates in the trailing four quarters, the average surprise being 66.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GlaxoSmithKline plc (GSK) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

BioRad Laboratories, Inc. (BIO) : Free Stock Analysis Report

To read this article on Zacks.com click here.