Energy to Power S&P 500's Q1 Earnings Growth: 5 Oil Picks

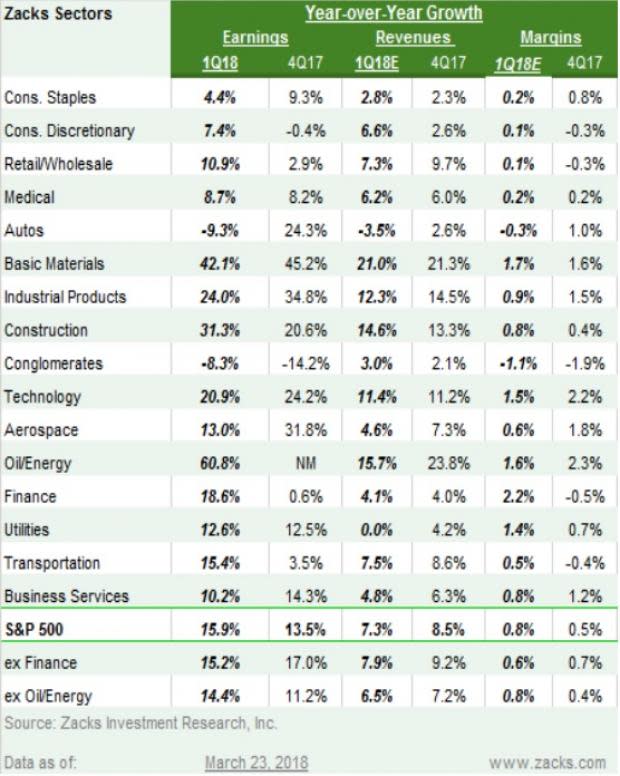

Major energy players on the S&P 500 index are expected to start reporting Q1 numbers starting mid-April. Like in the last three quarters, we expect the Energy sector to contribute majorly to the index’s earnings growth this time around. In fact, excluding Energy, we anticipate a drop in S&P 500’s earnings growth to 14.4% from 15.9%.

Last year, the sector generated $11.6 billion in net operating cashflow, which was enough to meet capital expenditures of $5.5 billion. This resulted in positive free cashflow of $6.1 billion in 2017, the highest since 2009.

We also believe that the healthy crude pricing scenario will help the sector report substantial free cashflow in Q1.

Oil Pricing Scenario Rosy

Per the U.S Energy Information Administration (EIA), average WTI crude prices for the first two months of 2018 have been $63.70 and $62.23 per barrel, respectively. The average monthly oil price had never traded near the $60 per barrel mark since 2015. Also, during the entire of March, the commodity traded above $60, reflecting a healthy pricing scenario.

The oil production cut extension deal signed by OPEC players late last year continued to support the rally in crude. On Nov 30, 2017, OPEC members met non-OPEC players to decide on an extension of the crude production cut accord, first signed in late 2016, beyond the first quarter of 2018. All crude exporters decided to extend the deal through 2018-end.

Strong Earnings Growth

We expect Energy to post the strongest earnings growth in first-quarter 2018, courtesy of the tick up in oil price. Compared with the January-to-March quarter of 2017, Energy is expected to see earnings growth of 60.8% on 15.7% higher revenues, per the latest Earnings Trends.

Notably, Energy’s Q1 earnings growth is expected to surpass 20.9% of the technology sector — the market’s largest segment with boundless investment opportunities. Moreover, for the second, third and fourth quarters of 2018, we project Energy’s earnings growth at 112.5%, 62.2% and 51.2% respectively.

For the first quarter of this year, we expect Energy to record $14.6 billion in earnings, higher than $11.4 billion and $9.1 billion in fourth-quarter 2017 and first-quarter 2017, respectively. On top of that, for the second, third and final quarters of 2018, we look forward to Energy raking in $17.3 billion, $17.8 billion and $17.3 billion, respectively.

Which Energy Players Will Make the Most?

The fate of upstream energy firms is largely dependent on oil prices. With increased exploration and production activities, a higher number of rigs will likely get hired and oil field services players are expected to clinch more contracts for setting up oil wells.

In fact, the market has seen a ramp up of crude drilling activities in the January-to-March quarter of 2018. As per data provided by Baker Hughes, a GE company BHGE – oilfield service provider – the total number of rigs exploring oil fields in the United States rose from 747 to 797 in the aforesaid quarter.

Choosing stocks with earnings beat potential might be a difficult task unless one knows the way to shortlist. One way to do this is to pick stocks that have the combination of a favorable Zacks Rank — #1 (Strong Buy), 2 (Buy) or 3 (Hold) — and a positive Earnings ESP.

Earnings ESP is our proprietary methodology for identifying stocks that have high chances of surprising in their upcoming earnings announcements. It shows the percentage difference between the Most Accurate estimate and the Zacks Consensus Estimate. Our research shows that for stocks with this combination, the chance of a positive earnings surprise is as high as 70%.

Headquartered in Houston, TX, EOG Resources, Inc. EOG is a leading explorer with oil and gas reserves across the United States, the U.K., China and Trinidad.

The company, expected to report Q1 numbers on May 4, sports a Zacks Rank #1 and an Earnings ESP of +3.87%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Pioneer Natural Resources Company PXD, headquartered in Dallas, TX, is a prime explorer with strong focus on the domestic crude and gas resources.

The company sports a Zacks Rank #1 and an Earnings ESP of +1.14% for the first quarter, which is expected to be reported on May 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Headquartered in Denver, CO, Antero Resources AR has operations related to exploration and development of oil and gas resources.

The Zacks #1 Ranked firm has an Earnings ESP of +7.67%. The upstream player is expected to report Q1 numbers on May 14.

Energen Corporation EGN, headquartered in Birmingham, AL, is a leading crude explorer with focus on oil-rich Permian Basin.

The company, with an Earnings ESP of +9.32%, carries a Zacks Rank of #2. Energen is expected to report results on May 3.

Based in Oklahoma City, Continental Resources CLR is also a leading crude explorer in the domestic market. The company, with an Earnings ESP of +5.98% and a Zacks Rank #1, is slated to release results on May 2.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Energen Corporation (EGN) : Free Stock Analysis Report

Pioneer Natural Resources Company (PXD) : Free Stock Analysis Report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

Antero Resources Corporation (AR) : Free Stock Analysis Report

Continental Resources, Inc. (CLR) : Free Stock Analysis Report

Baker Hughes Incorporated (BHGE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research