Eni (E) Explores Potential to Develop Biorefinery in Malaysia

Eni SpA E, together with partners Euglena and Petronas, is exploring the possibility of developing and operating a biorefinery in Malaysia.

Eni and partners are performing technical and economic feasibility assessments for the facility. The proposed biorefinery is expected to complete by 2025.

The biorefinery will be established in the Pengerang Integrated Complex, one of the largest integrated refinery and petrochemical facilities in Southeast Asia. The complex has easy access to major international shipping lanes. The favorable position will enhance the refinery’s ability to meet the rising demand for sustainable solutions worldwide.

The biorefinery would have a flexible configuration to maximize the production of sustainable aviation fuel for aircraft and hydrogenated vegetable oil for on-road vehicles, diesel-powered trains and marine transportation. The flexibility will enable the production to meet the rising customer demands.

The biorefinery is expected to have a processing capacity of 650,000 tons per annum of raw materials. It will have a production capacity of up to 12,500 barrels per day of biofuels, such as sustainable aviation fuel, hydrogenated vegetable oil and bio-naphtha. The Eni-developed ecofining process will be used in the proposed biorefinery.

Eni plans to achieve carbon neutrality by 2050 by reducing emissions generated throughout the entire product lifecycle. The latest collaboration is crucial for unlocking the companies’ abilities and improving their position in the field of biofuels in Malaysia and worldwide.

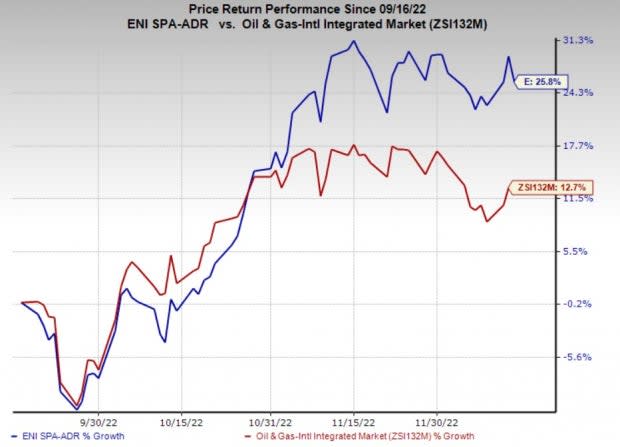

Price Performance

Shares of Eni have outperformed the industry in the past three months. The stock has gained 25.8% compared with the industry’s 12.7% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Eni currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Liberty Energy Inc. LBRT offers hydraulic fracturing services to onshore upstream energy companies across multiple basins in North America. LBRT’s third-quarter 2022 earnings per share of 78 cents beat the Zacks Consensus Estimate of 63 cents.

Liberty is expected to see an earnings surge of 298% in 2022. As of Sep 30, 2022, Liberty had $298 million of available liquidity, including $24 million cash on hand and supported by the revolving credit facility. LBRT’s debt-to-capitalization stands at just 15.2% compared with most peers hugely burdened with debts.

ProPetro Holding Corp. PUMP is an oilfield services provider operating primarily in the Permian Basin spread over west Texas and New Mexico. PUMP’s third-quarter 2022 earnings per share of 38 cents beat the Zacks Consensus Estimate of 36 cents.

PUMP is expected to see an earnings rise of 145.3% in 2022. As of Sept 30, ProPetro had $43.2 million in cash and cash equivalents, and total liquidity of $155 million. ProPetro’s balance sheet is debt-free, which provides a potential lifeline amid the difficult operating environment. The steep cutbacks to its capital budget further strengthen its financial position.

MPLX LP MPLX is a master limited partnership that provides a wide range of midstream energy services, including fuel distribution solutions. MPLX’s third-quarter earnings of 96 cents per unit beat the Zacks Consensus Estimate of 81 cents.

MPLX is expected to see an earnings rise of 29.7% in 2022. MPLX’s distribution per unit was 77.5 cents for the third quarter, indicating a 10% hike from the prior distribution of 70.5 cents. The distribution will be paid out on Nov 22, 2022, to common unitholders of record as of Nov 15, 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eni SpA (E) : Free Stock Analysis Report

MPLX LP (MPLX) : Free Stock Analysis Report

ProPetro Holding Corp. (PUMP) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report