Enterprise (EPD) Signs $3.25B Deal to Buy Navitas Midstream

Enterprise Products Partners LP EPD recently announced an agreement to acquire Navitas Midstream Partners, LLC, from an affiliate of Warburg Pincus LLC. The transaction, likely to get completed by the first quarter of 2022, will be debt free and the cash consideration is set at $3.25 billion.

With the accord, Enterprise Products is entering the prolific Midland basin and will capitalize on the mounting demand for natural gas infrastructure. In the core of the basin, a sub-basin of the broader Permian, Navitas Midstream, provides services related to natural gas gathering, treating and processing.

The assets of Navitas Midstream that Enterprise Products is expected to acquire include pipeline networks, spreading across roughly 1,750 miles along with a cryogenic natural gas processing capacity of more than 1 billion cubic feet per day.

Enterprise Products strongly expects the transaction to be accretive to distributable cash flow per unit as soon as it closes.Considering its latest outlook for commodity prices, Enterprise Products expects distributable cash flow accretion of 18 cents to 22 cents per unit in 2023.

The investment will provide lucrative capital returns and additional capital returns to the limited partners, backed by distribution hikes and unit buybacks.

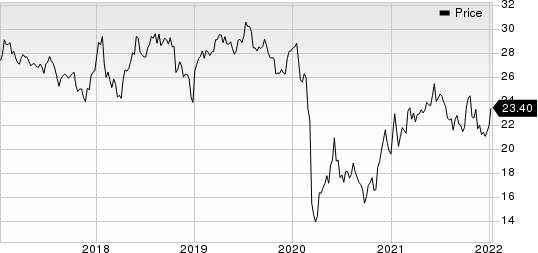

Enterprise Products Partners L.P. Price

Enterprise Products Partners L.P. price | Enterprise Products Partners L.P. Quote

Enterprise Products currently carries a Zacks Rank #3 (Hold). Meanwhile, a few better-ranked players in the energy space include Murphy USA Inc. MUSA, The Williams Companies Inc WMB and MPLX LP MPLX. While Murphy USA sports a Zacks Rank #1 (Strong Buy), The Williams Companies and MPLX carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Murphy USA is well-positioned to gain from improving gasoline demand in the coming months since it is a prominent retailer of gasoline and convenience merchandise. Having a network of retail gasoline and convenience stores in 27 states, Murphy USA can serve an estimated two million customers every day.

Over the past 30 days, Murphy USA has witnessed upward earnings estimate revisions for 2021 and 2022.

The Williams Companies is well poised to capitalize on mounting demand for clean energy since it is engaged in transporting, storing, gathering and processing natural gas and natural gas liquids.

With its pipeline networks spread across more than 30,000 miles, The Williams Companies connects premium basins in the United States to the key market. WMB’s assets can fulfill 30% of the nation’s natural gas consumption, utilized for heating purposes and clean-energy generation.

MPLX LP generates stable cashflows and has lower exposure to commodity price volatility since it operates midstream energy infrastructure and logistics assets. MPLX LP also generates cashflows from the fuels distribution business.

Over the past 60 days, MPLX LP has witnessed upward earnings estimate revisions for 2021 and 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Williams Companies, Inc. The (WMB) : Free Stock Analysis Report

Enterprise Products Partners L.P. (EPD) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

MPLX LP (MPLX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research