Flavor Of The Month: Arotech And More

Stocks, such as Arotech and Owens & Minor, are trading at a value below what they may actually be worth. There’s a few ways you can measure the value of a company – you can forecast how much money it will make in the future and base your valuation off of this, or you can look around at its peers of similar size and industry to roughly estimate what it should be worth. Below, I’ve created a list of companies that compare favourably in all criteria based on their most recent financial data, making them potentially good investments.

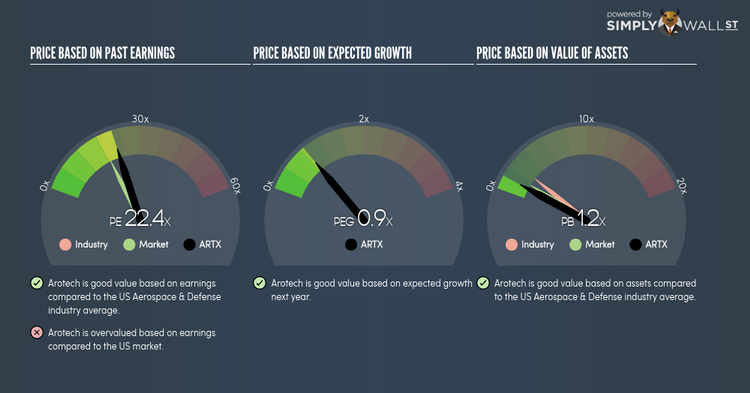

Arotech Corporation (NASDAQ:ARTX)

Arotech Corporation provides defense and security products worldwide. Started in 1990, and now run by Dean Krutty, the company now has 514 employees and with the stock’s market cap sitting at USD $81.74M, it comes under the small-cap stocks category.

ARTX’s shares are currently trading at -24% less than its intrinsic value of $4.28, at the market price of US$3.25, based on my discounted cash flow model. This mismatch signals an opportunity to buy ARTX shares at a discount.

ARTX is also strong financially, with near-term assets able to cover upcoming and long-term liabilities. Finally, its debt relative to equity is 22.38%, which has been dropping for the past few years demonstrating ARTX’s capability to pay down its debt. More detail on Arotech here.

Owens & Minor, Inc. (NYSE:OMI)

Owens & Minor, Inc., together with its subsidiaries, operates as a healthcare services company in the United States, the United Kingdom, Ireland, France, Germany, and other European countries. Founded in 1882, and now run by Paul Phipps, the company now has 8,600 employees and has a market cap of USD $1.03B, putting it in the small-cap group.

OMI’s stock is currently trading at -25% beneath its intrinsic value of $22.15, at a price tag of US$16.57, based on its expected future cash flows. The mismatch signals a potential chance to invest in OMI at a discounted price. Furthermore, OMI’s PE ratio is currently around 13.86x while its Healthcare peer level trades at, 19.84x suggesting that relative to its comparable company group, we can purchase OMI’s shares for cheaper. OMI is also robust in terms of financial health, as current assets can cover liabilities in the near term and over the long run.

Dig deeper into Owens & Minor here.

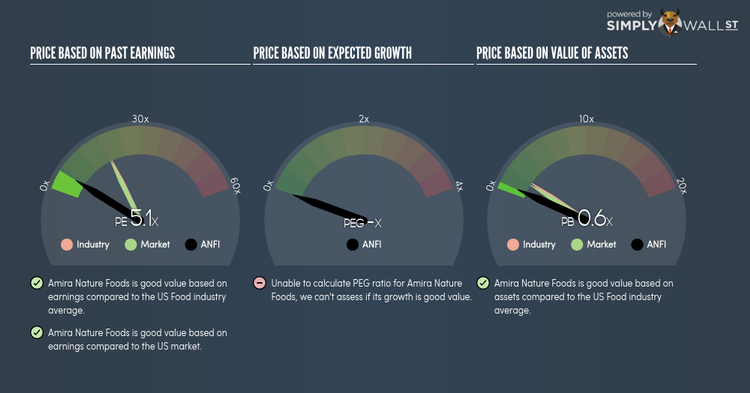

Amira Nature Foods Ltd. (NYSE:ANFI)

Amira Nature Foods Ltd. engages in processing, sourcing, and selling packaged Indian specialty rice. Started in 1915, and currently headed by CEO Karan Chanana, the company provides employment to 224 people and with the market cap of USD $178.27M, it falls under the small-cap stocks category.

ANFI’s shares are currently hovering at around -63% lower than its value of $11.61, at a price of US$4.34, based on its expected future cash flows. signalling an opportunity to buy the stock at a low price. Furthermore, ANFI’s PE ratio stands at around 5.14x relative to its Food peer level of, 19.2x indicating that relative to other stocks in the industry, we can buy ANFI’s stock at a cheaper price today. ANFI is also a financially healthy company, with short-term assets covering liabilities in the near future as well as in the long run. It’s debt-to-equity ratio of 71.66% has been declining for the past few years signalling its capability to pay down its debt. Continue research on Amira Nature Foods here.

Or create your own list by filtering companies based on fundamentals such as intrinsic discount, health score and future outlook using this free stock screener.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.