Forex: Australian Dollar Braces for Impact as US Data Backlog Emerges

Australian Dollar Braces for Impact as US Data Backlog Emerges

Fundamental Forecast for Australian Dollar: Bullish

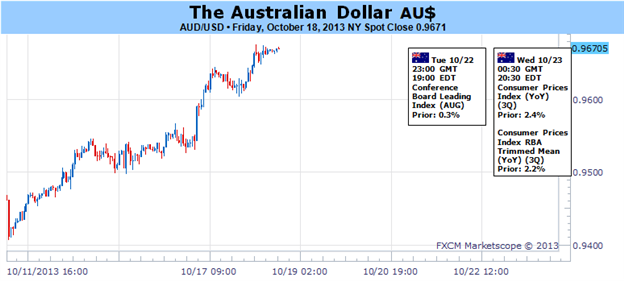

Australian Dollar Recovery Meets First Objective as AUD/USD Overcomes 0.96

Risk Aversion Still a Threat as US Data Backlog Informs Fed QE “Taper” Bets

DailyFX SSI Shows Speculative Sentiment Balance Favors Aussie Dollar Gains

We’ve argued in favor of a significant Australian Dollar recoverysince early August. We thought an improvement in Chinese news-flow will help arrest the slide in economic growth expectations for the East Asian giant, boosting the outlook for Australia’s mining sector exports and prompting a positive shift in the RBA policy bets. The case for an upside scenario seemed all the more compelling against a backdrop of highly over-extended speculative net-short positioning and we proceeded toenter long AUD/USDafter an attractive technical setup presented itself, targeting 0.9640 as an initial objective.

Prices turned higher as expected, with the latest COT positioning data pointing to aggressive short-covering. Furthermore, not only have RBA interest rate cut expectations fizzled, but a gauge of priced-in policy bets from Credit Suisse touched the highest level since May 2011 last week, calling for modest tightening in the next 12 months. The week ahead will test the Aussie’s resilience however amid a slew of top-tier US economic data.

The Aussie is still significantly sensitive to broad-based risk appetite trends, with AUD/USD showing notable correlations to various measures of market sentiment including the S&P 500 and the MSCI World Stock Index. That makes for a vulnerability to the outbreak of risk aversion as two weeks’-worth of data delayed amid the US government shutdown emerges. While the spotlight will almost certainly fall on September’s Employment report (due on Tuesday), a large stock of releases yet to be scheduled is in the queue.

For FX markets, US budget turmoil was viewed through the prism of Fed policy expectations, with a longer period of fiscal retrenchment seen as delaying a move to “taper” the size of QE3 asset purchases. Now that an end-point to the shutdown has been established, traders will be attempting to handicap its impact on US growth in the fourth quarter and beyond to gauge when Ben Bernanke and company may feel comfortable to begin dialing back stimulus.

Although the backlog of US news-flow is dated in that they will not reflect the shutdown’s impact, it will help establish a baseline and help gauge how ready to act the Fed had been going into October. Supportive news-flow is likely to weight on the Aussie along with broad-based risk appetite on the expectation that US fiscal woes will only modestly delay the “tapering” process. Needless to say, signs of weakening performance stand to yield the opposite result.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.