FPA Crescent Fund Cuts Facebook, Broadcom

- By Tiziano Frateschi

Steven Romick (Trades, Portfolio)'s FPA Crescent Fund sold shares of the following stocks during its third quarter of fiscal 2020, which ended on Sept. 30.

Broadcom

The fund trimmed its position in Broadcom Inc. (AVGO) by 22.48%. The trade had an impact of -1% on the portfolio.

The company has a market cap of $154.31 billion and an enterprise value of $189.61 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 9.42% and return on assets of 3.27% are outperforming 52% of companies in the semiconductors industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.2 is above the industry median of 1.43.

The largest guru shareholder of the stock is Barrow, Hanley, Mewhinney & Strauss with 0.42% of outstanding shares, followed by First Pacific Advisors (Trades, Portfolio) with 0.33% and Romick with 0.19%.

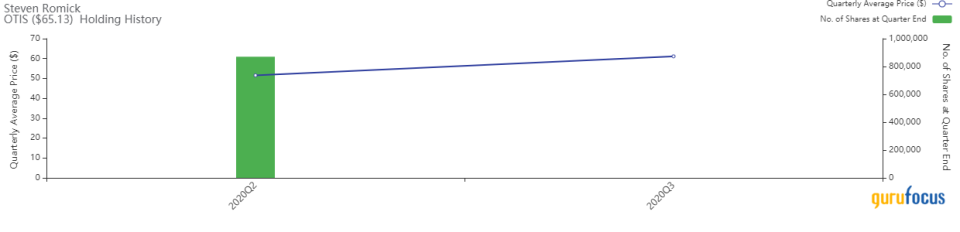

Otis Worldwide

The fund's Otis Worldwide Corp. (OTIS) position was closed. The portfolio was impacted by -0.72%.

The elevator and escalator supplier has a market cap of $28.21.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The return on equity of 60.26% and return on assets of 11.86% are outperforming 94% of companies in the industrial products industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 2.58 is above the industry median of 0.98.

The largest guru shareholder is Dodge & Cox with 2.20% of outstanding shares, followed by Ken Fisher (Trades, Portfolio) with 0.49% and Pioneer Investments (Trades, Portfolio) with 0.41%.

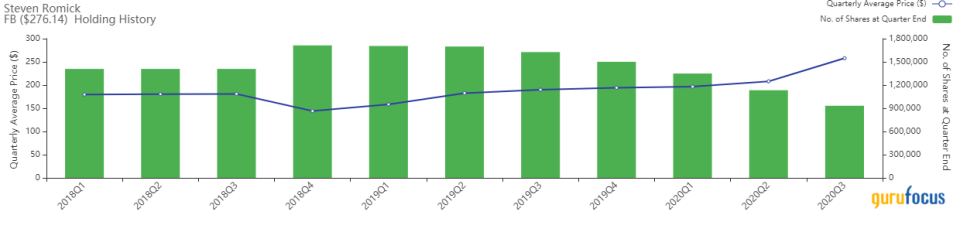

The guru's fund curbed its position in Facebook Inc. (FB) by 17.72%. The portfolio was impacted by -0.66%.

The online social network has a market cap of $786.67 billion and an enterprise value of $738.96 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 23.54% and return on assets of 18.01% are outperforming 83% of companies in the interactive media industry. Its financial strength is rated 8 out of 10. The cash-debt ratio of 5.53 is below the industry median of 4.39.

The largest guru shareholder is Chase Coleman (Trades, Portfolio)'s Tiger Global Management with 0.31% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.20% and Spiros Segalas (Trades, Portfolio) with 0.19%.

Comcast

The fund reduced its Comcast Corp. (CMCSA) holding by 13.08%, impacting the portfolio by -0.62%.

The company has a market cap of $209.63 billion and an enterprise value of $301.68 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 14.29% and return on assets of 4.41% are outperforming 76.01% of companies in the media, diversified industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.13 is above the industry median of 0.91.

The largest guru shareholder is Dodge & Cox with 1.83% of outstanding shares, followed by First Eagle Investment (Trades, Portfolio) with 0.71% and Andreas Halvorsen (Trades, Portfolio) with 0.62%.

Microsoft

The investment fund curbed its holding of Microsoft Corp. (MSFT) by 21.13%. The portfolio was impacted by -0.59%.

The hardware and software producer has a market cap of $1.69 trillion and an enterprise value of $1.62 trillion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 40.16% and return on assets of 15.43% are outperforming 92% of companies in the software industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 1.92 is below the industry median of 2.2.

The largest guru shareholder of the company is PRIMECAP Management (Trades, Portfolio) with 0.32% of outstanding shares, followed by Fisher with 0.29%, Pioneer Investments (Trades, Portfolio) with 0.27% and Dodge & Cox with 0.26%.

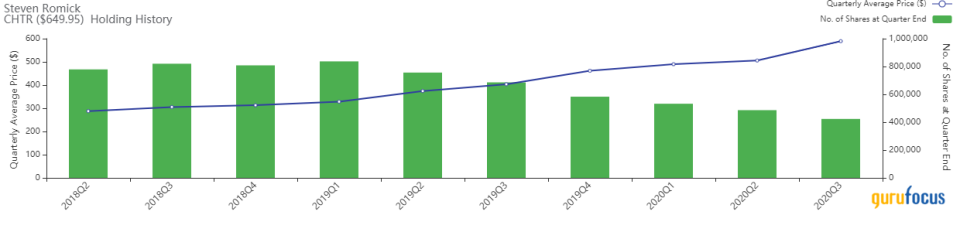

Charter Communications

The investment fund trimmed its Charter Communications Inc. (CHTR) position by 12.96%. The trade had an impact of -0.47% on the portfolio.

The company, which provides networks, television, Internet access and phone services, has a market cap of $133.17 billion and an enterprise value of $216.71 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 7.13% and return on assets of 1.56% are outperforming 61% of companies in the media, diversified industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.03 is far below the industry median of 0.91.

The largest guru shareholder of the company is Dodge & Cox with 2.58% of outstanding shares, followed by Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway with 2.54% and Frank Sands (Trades, Portfolio) with 0.49%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Undervalued Industrial Companies Boosting Earnings

5 Companies Trading With Low Price-Earnings Ratios

The Parnassus Fund Exits Trimble, Dentsply Sirona

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.