Francis Chou Slims 4 Positions in the 1st Quarter

Francis Chou (Trades, Portfolio), manager of Chou Associates, disclosed this week that he curbed his holdings in DaVita Inc. (NYSE:DVA), Bausch Health Companies Inc. (NYSE:BHC), JPMorgan Chase & Co. (NYSE:JPM) and Bank of America Corp. (NYSE:BAC) during the first quarter.

Chou, who met Fairfax Financial Holdings Ltd. (TSX:FFH) CEO Prem Watsa (Trades, Portfolio) in the 1980s, said that some of his key investing tips include buying bargains and thinking independently. Chou's investing process emphasizes the assessment of a company's balance sheet, cash flow characteristics, profitability, industry position, special strengths, future growth potential and management ability.

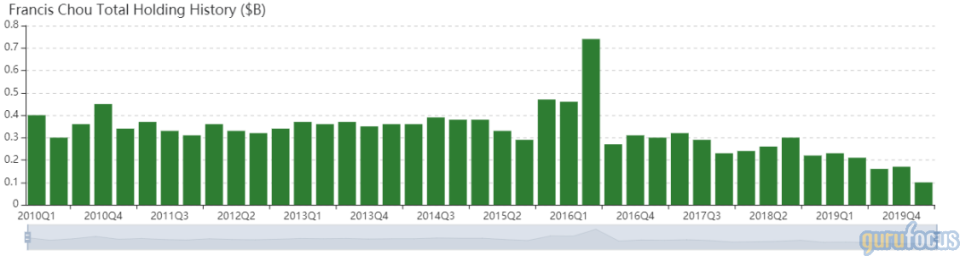

As of the quarter-end, Chou's $100 million equity portfolio contains 19 positions with no new holdings. The top three sectors in terms of weight are financial services, health care and basic materials, representing 60.93%, 27.54% and 6.46% of the equity portfolio.

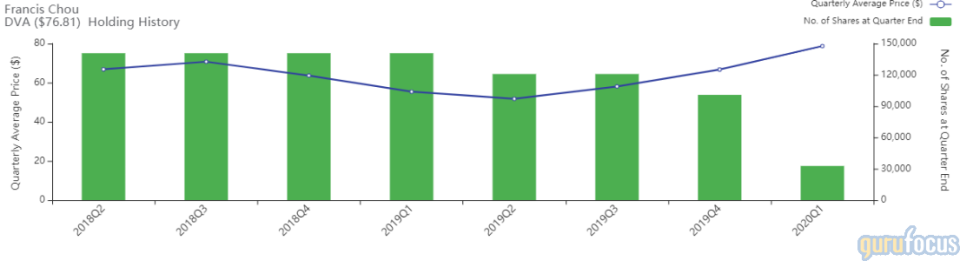

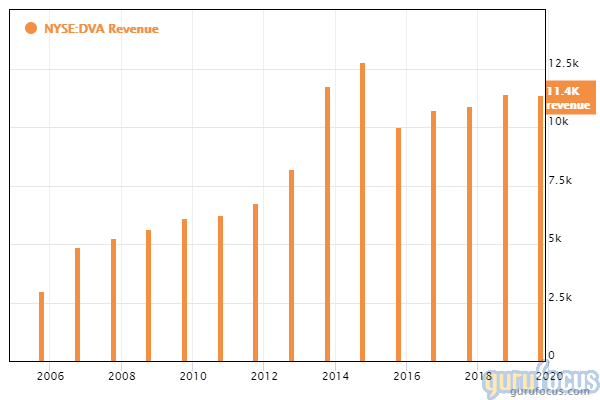

DaVita

Chou sold 68,000 shares of DaVita, reducing the position 67.50% and the equity portfolio 2.97%. Shares averaged $78.69 during the first quarter.

The Denver-based company provides dialysis services in the U.S. GuruFocus ranks DaVita's profitability 9 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7, consistent revenue growth and an operating margin that is outperforming over 83% of global competitors.

Berkshire owns 38,095,570 shares of DaVita as of March quarter-end, down approximately 1.22% from the prior quarter holding.

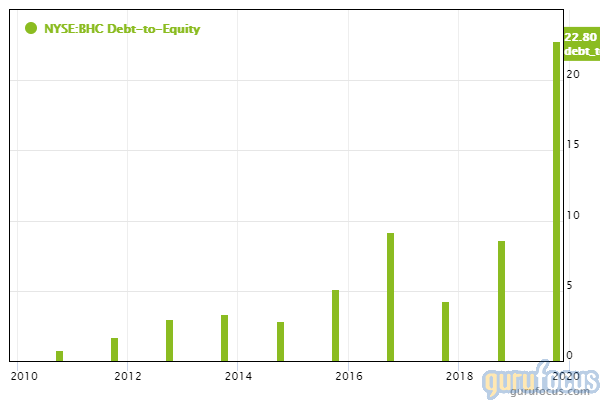

Bausch Health

Chou sold 60,000 shares of Bausch Health. The transaction trimmed the position just 3.71% despite reducing the equity portfolio 1.04%. Shares averaged $24.35 during the first quarter.

The Laval, Quebec-based company manufactures products for the dermatology, gastrointestinal and ophthalmology markets. GuruFocus ranks the company's financial strength 2 out of 10 on several warning signs, which include interest coverage and debt ratios underperforming over 95% of global competitors.

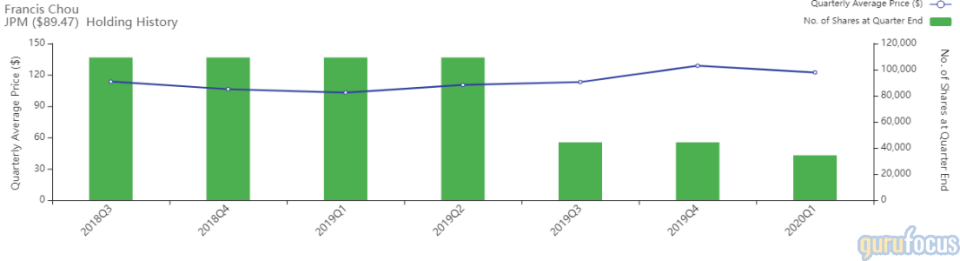

JPMorgan Chase

Chou sold 10,000 shares of JPMorgan Chase, reducing the position 22.59% and the equity portfolio 0.81%. Shares averaged $122.27 during the first quarter.

The New York-based bank operates four financial service businesses: consumer and community banking, corporate and investment banking, commercial banking and asset and wealth management. GuruFocus ranks the company's financial strength 3 out of 10 on the back of equity-to-asset and debt-to-equity ratios underperforming over 70% of global competitors, warning signs of high leverage.

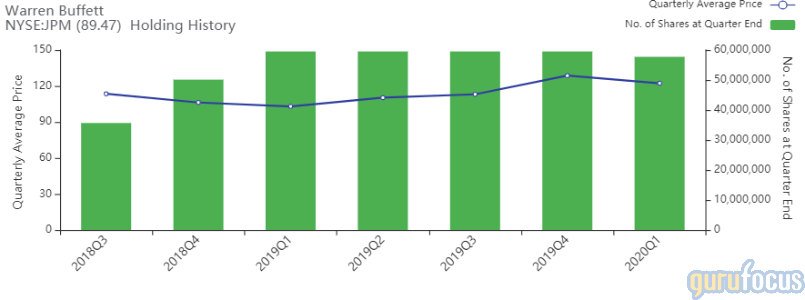

Berkshire owns 57,714,433 shares of JPMorgan Chase as of the March quarter, down 3.03% from the prior quarter holding.

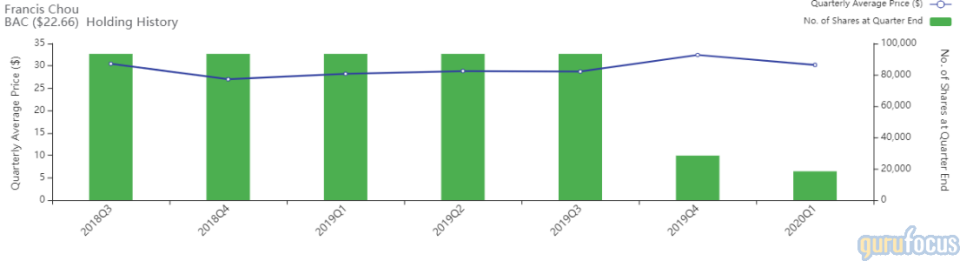

Bank of America

Chou sold 10,000 shares of Bank of America, reducing the position 35.24% and the equity portfolio 0.20%. Shares averaged $30.21 during the first quarter.

The Charlotte, North Carolina-based bank operates four business segments: consumer banking, global wealth and investment management, global banking and global markets. According to GuruFocus, Bank of America's financial strength ranks 3 out of 10 on the heels of increasing long-term debt over the past three years, contributing to debt ratios that underperform over 67% of global competitors. Despite this, Bank of America's equity-to-asset ratio of 0.10 outperforms 51% of global banks.

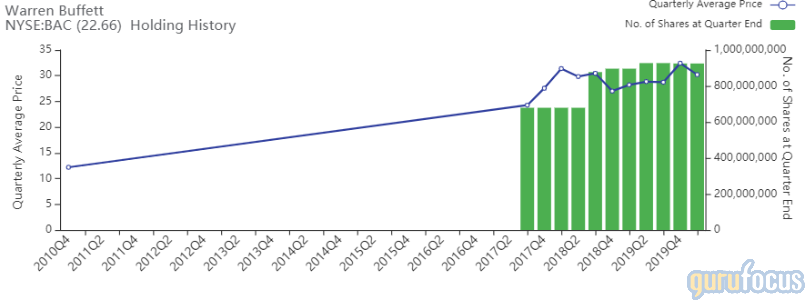

Berkshire owns 925,008,600 shares of Bank of America as of the March quarter. With a weight of 11.19%, the bank represent's Berkshire's second-largest holding.

Disclosure: No positions.

Read more here:

Warren Buffett's Top 5 Holdings as of the 1st Quarter

Prem Watsa's Top 5 Buys in the 1st Quarter

Seth Klarman's Top 5 New Buys in the 1st Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.