FTI Consulting (FCN) Tech Segment Extends Alliance With Reveal

FTI Consulting, Inc. FCN announced the expansion of its existing partnership with Reveal, which will enable FCN to offer solutions provided on the Reveal 11 platform, including global data hosting and early case assessment. The partnership is expected to positively impact the company’s technology segment.

Reveal is a global provider of AI-powered eDiscovery platform and has a client base of law firms, intelligence services, and government agencies. The company along with Brainspace technology provides a full suite of eDiscovery solutions through a single platform.

Benefits to FTI Consulting

Quoting Sophie Ross, Global Chief Executive Officer of FTI Technology, “As clients grapple with the impacts that soaring data volumes and complex emerging data sources have on their investigations workflows, they need powerful solutions that can provide reliable insights early in a matter.”

FTI Technology (the Technology segment of FTI Consulting) has an existing partnership with Brainspace that has been acquired by Reveal in 2020. Reveal’s AI and advanced analytics shall enable FCN in enriching data and carryingout advanced processing of high sensitivity data, selective promotion in the client’s chosen document review platform,, reducing data volume and providing fast insight during early case assessment.

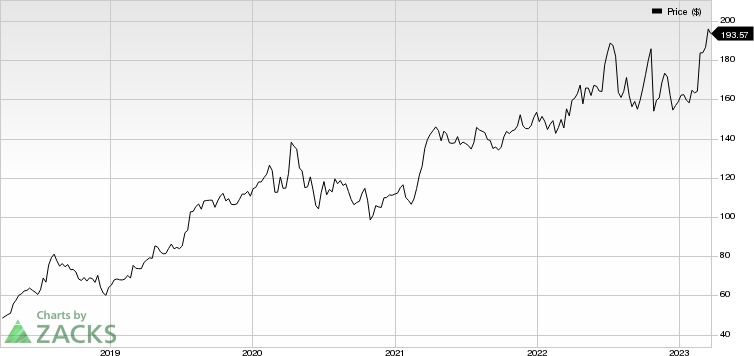

FTI Consulting has had an impressive run on the bourses in the past year. The stock gained 27.7% against 17.1% decline of the industry it belongs to.

FTI Consulting, Inc. Price

FTI Consulting, Inc. price | FTI Consulting, Inc. Quote

FTI Consulting currently carries a Zacks Ranks #3 (Hold).

Stocks to Consider

Here are a few stocks from the broader Business Services sector, which can be a good investment opportunity.

Omnicom Group's OMC internal development initiatives and shareholder-friendly policies ensure long-term profitability. The Zacks Consensus Estimate for the company’s first-quarter 2023 earnings is pegged at $1.40, which has been revised downward 1.4% in the past 60 days. For first-quarter 2023, OMC’s earnings are expected to grow slightly from the year-ago reported figure to $1.40. The company beat the Zacks Consensus Estimate in the four trailing quarters with the average surprise being 8%. OMC currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

ICF International ICFI is being aided by the strong government business, courtesy of improvement in the business development pipeline and win rate. The Zacks Consensus Estimate for the company’s first-quarter 2023 earnings is pegged at $1.41, which has been revised upward 6% in the past 60 days. For first-quarter 2023, ICFI’s earnings are expected to register 7.6% growth on a year-over-year basis. The company beat the Zacks Consensus Estimate in the four trailing quarters, with the average surprise being 9.2%. ICFI currently sports a Zacks Rank of 1.

Gartner IT is being aided by the diverse addressable market with low customer concentration. The Zacks Consensus Estimate for the company’s first-quarter 2023 earnings is pegged at $2.04, which has been revised upward 3.6% in the past 60 days. For first-quarter 2023, IT's earnings are expected to register a 12.5% fall on a year-over-year basis. The company beat the Zacks Consensus Estimate in the four trailing quarters with an average surprise of 32.7%. Gartner currently carries a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

ICF International, Inc. (ICFI) : Free Stock Analysis Report