Gentex Corporation (NASDAQ:GNTX) Insiders Have Been Selling

It is not uncommon to see companies perform well in the years after insiders buy shares. On the other hand, we’d be remiss not to mention that insider sales have been known to precede tough periods for a business. So before you buy or sell Gentex Corporation (NASDAQ:GNTX), you may well want to know whether insiders have been buying or selling.

What Is Insider Buying?

It’s quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, rules govern insider transactions, and certain disclosures are required.

Insider transactions are not the most important thing when it comes to long-term investing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. For example, a Harvard University study found that ‘insider purchases earn abnormal returns of more than 6% per year.’

View our latest analysis for Gentex

Want to help shape the future of investing tools and platforms? Take the survey and be part of one of the most advanced studies of stock market investors to date.

The Last 12 Months Of Insider Transactions At Gentex

Over the last year, we can see that the biggest insider sale was by President & CEO Steven Downing for US$387k worth of shares, at about US$21.50 per share. So it’s clear an insider wanted to take some cash off the table, even below the current price of US$22.07. While their view may have changed since they sold, this isn’t a particularly bullish sign. As a general rule we consider it to be discouraging when insiders are selling below the current price. We note that the biggest single sale was only 15.5% of Steven Downing’s holding.

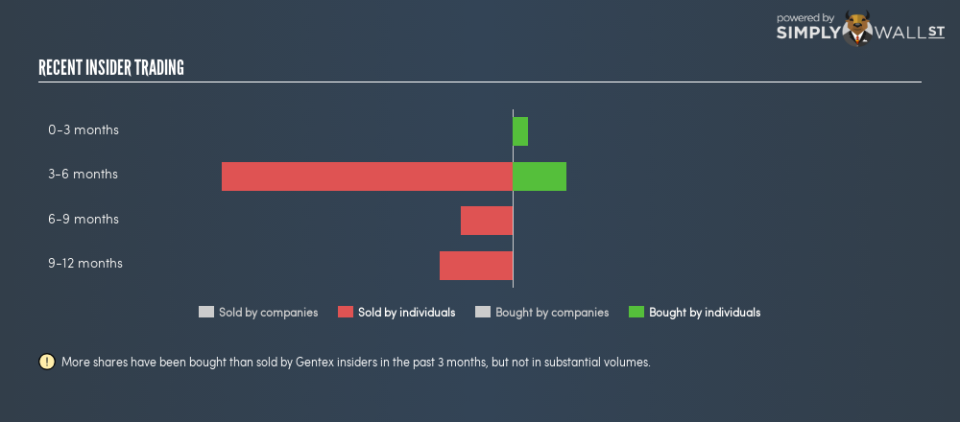

Over the last year, we can see that insiders have bought 6.62k shares worth US$146k. But insiders sold 40.00k shares worth US$891k. In total, Gentex insiders sold more than they bought over the last year. The average sell price was around US$22.28. We don’t gain confidence from insider selling below the recent share price. Of course, the sales could be motivated for a multitude of reasons, so we shouldn’t jump to conclusions. You can see a visual depiction of insider transactions (by individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Gentex is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Insiders at Gentex Have Bought Stock Recently

There was some insider buying at Gentex over the last quarter. Insiders purchased US$28k worth of shares in that period. We like it when there are only buyers, and no sellers. However, in this case the amount invested recently is quite small.

Insider Ownership

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. From our data, it seems that Gentex insiders own 0.2% of the company, worth about US$9.8m. Overall, this level of ownership isn’t that impressive, but it’s certainly better than nothing!

So What Do The Gentex Insider Transactions Indicate?

We note a that there has been a tad more insider buying than selling, recently. But the difference isn’t much. The insider transactions at Gentex are not inspiring us to buy. And we’re not picking up on high enough insider ownership to give us any comfort. If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

If you would prefer to check out another company — one with potentially superior financials — then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.