Are All Global Managers Created (Globally) Equal?

By: Janus Henderson Investors

Harvest Exchange

October 30, 2017

Are All Global Managers Created (Globally) Equal?

As the Janus Henderson Portfolio Construction Services Team consults with advisors on all aspects of their portfolios, equity home bias continues to be a prominent topic. Given optimism around future returns in both the U.S. and overseas markets, global equity managers have been an increasingly common tool investors are using to navigate these opportunities.

Indeed, the Morningstar World Stock category is the second-most popular category in the Morningstar International Equity group for active managers and its constituent funds are held in 21% of the advisor portfolios we’ve seen. While these global strategies may be a popular position in portfolios, they are no panacea. Each global manager has its own set of goals, mandates and biases that need to be examined before being placed into a portfolio.

Home Court Advantage?

From an asset allocation perspective, perhaps the most important facet is each manager’s U.S.-centricity, or lack thereof. Given the U.S. equity market share of at least half of global markets (measured by MSCI All Country World Index), it follows that many global managers might be redundant with at least half of an investor’s remaining equity portfolio. Therefore, global managers with a domestic bias do very little for investors looking to make a more global footprint with their equity portfolios.

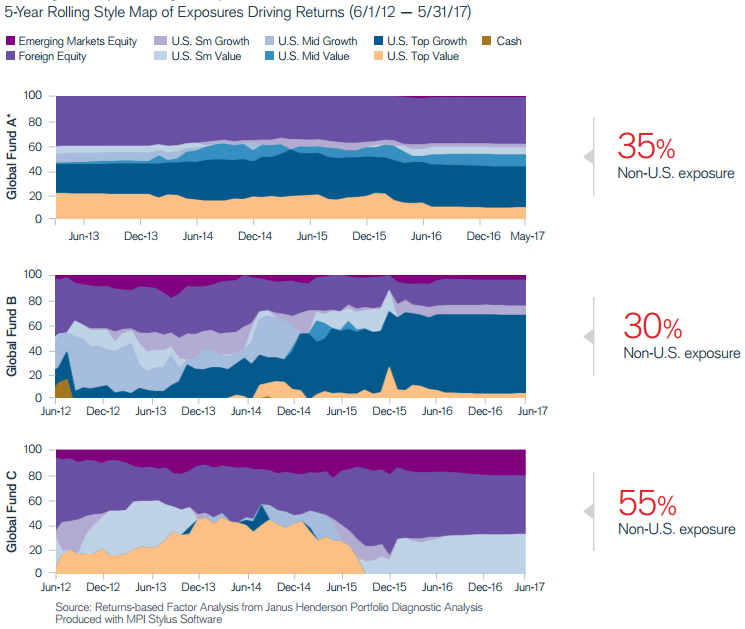

For example, below is one way in which we take a deeper look at global managers and their impact in a portfolio. These mountain charts illustrate the U.S. vs. non-U.S. exposure over time for each of the fastest-growing global equity mutual funds in the category, based on trailing three-year inflows. Based on these factor breakdowns, consider an advisor who moves 10% into one of these global managers: given the U.S. exposure in these funds, only about 40% of that position on average – or 4% of the model – is actually being allocated to international equities.

Thinking Globally, Investing Locally

Picking a Better Bias

Global managers can be compelling, but it is easy to over-allocate to U.S. stocks with these strategies. These managers can be valuable in that they allow investors the ability to delegate decisions around allocating to U.S. versus overseas equities. However, given the prominence of equity home bias in investor portfolios, many investors also rely on global managers to help make their portfolios truly global – in which case, a deeper analysis should illuminate the investment options that provide a foreign bias and better help investors attain their global diversification goals.

To learn more about whether your clients’ portfolios have been limited by home bias, visit our Portfolio Strategies resources.

To read more insights from our experts,

*Global Fund A has an inception date of March 2013

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

Originally Published at: Are All Global Managers Created (Globally) Equal?