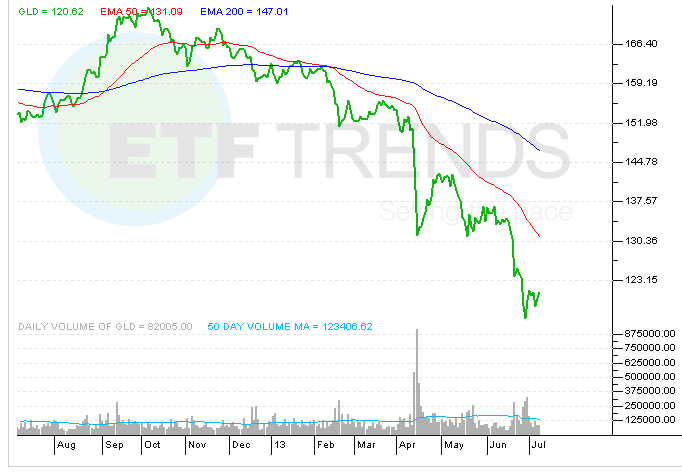

Gold ETF Falls 9% on Record Trading Volume

SPDR Gold Shares (GLD) crashed nearly 9% on Monday as more than 90 million shares traded hands, an all-time high.

Monday’s action exceeded the previous volume record of 79.2 million shares set on December 4, 2009.

Not including Monday’s redemptions, GLD had seen net outflows of $9.8 billion year to date, according to IndexUniverse. That is nearly triple the ETF with the next-largest outflows. [Gold ETF Lowest Since 2011 as Key Support May Crumble]

“Gold doesn’t really model well on a supply-demand basis, but those ETF flows are enormous,” Queen Anne’s Gate Capital CIO Kathleen Kelley said in a CNBC.com report.

The CBOE Gold ETF Volatility Index, known as the “Gold VIX,” jumped more than 60% on Monday as bullion prices dropped below $1,400 an ounce, Reuters reports. The benchmark measures the market’s expectations of how volatile SPDR Gold Shares will be in the next month.

GLD is down 23% the past six months with gold falling into a bear market after the 2011 all-time high.

SPDR Gold Shares

Full disclosure: Tom Lydon’s clients own GLD.

The opinions and forecasts expressed herein are solely those of John Spence, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.