Gold Monthly Forecast – February 2018

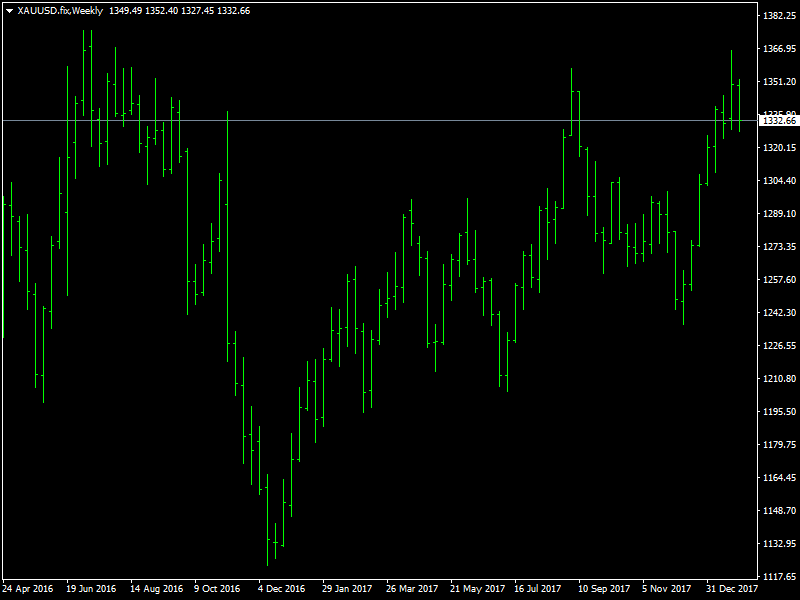

Gold prices continued to move higher as the dollar weakened all across the board. We saw the prices move from the lows 1300s towards the 1350 region and beyond, during the course of the month and it remains to be seen whether the bull run would continue in the coming month as well. Also, the rise during the course of the last 2 months have been on low volume, especially in December and this had led to expectations that the price rise would reverse during January when the full volume returned.

Gold Prices Move Higher

But it was a surprise for many of the traders when the gold prices continued to rise through the month despite some heavy volume coming in. This mainly happened due to the weakening dollar. There has not been anything fundamental that has been associated with the weakness in the dollar. In fact, the incoming data from the US during January had been pretty steady and this should have helped the dollar under normal circumstances.

But there were some geopolitical issues concerning the US and other countries during the month which added to the pressure on the dollar and led to a lot of uncertainty in the markets as well. During such situations, it is normal for the funds to flow into safe havens like gold and this is probably one of the reasons for the gold prices to move higher during the month of January. The Fed did not show too much concern about the weakness in the dollar and that led to even further weakening in the dollar during the month.

Looking ahead to the coming month of February, we expect the situation to get more interesting as we expect the dollar to begin its rebound after a prolonged slump over the last couple of months. We are likely to enter into a phase when the focus is going to be on the dollar. The Fed will have a new Chief in Powell who will be replacing Yellen and it remains to be seen whether he would be a bullish or a bearish Fed chief. Also, on the other hand, the traders would be watching the incoming economic data from the US for signs of strength in the US economy. The market is looking forward to atleast 3 rate hikes from the Fed during the course of this year.

Dollar Expected to Rebound

The market, though, would expect the Fed to try for 4 hikes this year if the incoming data continues to be very strong. That is why it is important that theUS comes up with some strong economic data in February as the first rate hike is expected to be in March. The Fed needs support from the economic data as that would be the guiding light for their decision making. This is the reason why we believe that the gold prices are likely to find the going tough in the weeks ahead. The gold prices hit a strong resistance in the 1360 region and if the Fed signals further rate hikes as per the market expectations, the gold prices would come under pressure immediately.

Also, we are seeing the yields beginning to rise all around the globe and that is also likely to place some pressure on the gold prices. The reason is that, with the increase in interest rates and yields, the funds are likely to get diverted from the gold market and into these, in the hope of better and safer returns. This should push the prices lower and the regions around 1345 and 1325 are likely to act as regions of support in case the tide turns in the gold market. On the upper side, we are likely to see the 1360 region act as strong resistance. In between these, we can expect a lot of choppiness in the prices as the traders and the markets decide which way the trend is going to go in.

This article was originally posted on FX Empire

More From FXEMPIRE:

DAX Index Price forecast for the week of February 5, 2018, Technical Analysis

Bitcoin Price forecast for the week of February 5, 2018, Technical Analysis

Crude Oil Price Update – Trend Changes to Down on Move Through $63.67

FTSE 100 Index Price forecast for the week of February 5, 2018, Technical Analysis

Alt Coins Price forecast for the week of February 5, 2018, Technical Analysis