Gurus Look Beyond National Oilwell Varco's Immediate Future

As I mentioned in an earlier article about Dupont (NYSE:DD), GuruFocus provides a list of guru buys and sells, in several formats. The gurus are investing giants, managers of funds that have attracted billions of dollars of investors' capital. Altogether, GuruFocus follows 151 of them.

The list can be sorted in several ways; Dupont was first when the list was sorted by most vuys. Other options include owns, sells and net buys. The latter is calculated by subtracting the number of sells from the number of buys, giving us an indication of guru confidence for each stock in the GuruFocus database.

Would it surprise you to learn that the top stock on the net buys list hails from the oil and gas industry? National Oilwell Varco Inc. (NYSE:NOV) currently has 10 net buys, that is, 11 gurus have bought shares and 1 has sold.

It's surprising because no sector or industry has been beaten down as much as oil and gas. Prior to 2014, the industry had been booming, based on increasing demand from emerging economies (especially China and India) and output cuts by the OPEC nations. Demand eased for a time as the 2008 financial crisis dampened demand, but the financial recovery also stimulated oil and gas prices again. For several years, prices were well over $100 per barrel.

In response to these prices, the industry attracted and put to work a lot of new capital. That increased production, particularly from shale oil in the U.S. and oil sands in Canada. In addition, China's demand had slowed and Saudi Arabia ramped up its production. The result was an oil glut that became apparent in 2014.

According to MacroTrends, the average price per barrel of West Texas Intermediate crude oil dropped from an average of $93.17 in 2014 to $48.66 in 2015 (on May 14, the price was $27.62 a barrel).

After 2016, the industry began a slow and halting recovery, but the price had climbed enough to at least cover the cost of production.

But hopes of seeing profits across the industry were dashed in early March of this year, as Saudi Arabia and Russia began a price war. At about the same time, North America and Europe began to experience the effects of the Covid-19 crisis. As economic activity slowed down, so too did demand, which further depressed oil and gas activity as well as share prices.

Recovery in the industry will have to wait for economic conditions to normalize again, though some observers argue that the pre-pandemic normal will not return.

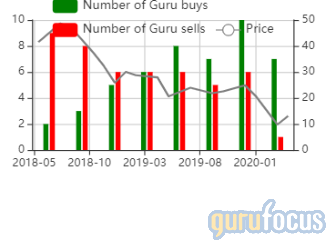

There are at least a dozen gurus who are not among those predicting a "new normal," with little demand for fossil fuels, including oil and gas. Twelve gurus have holdings in National Oilwell Varco. The largest is Richard Pzena (Trades, Portfolio) of Pzena Investment Management (nearly 32 million shares at the end of the first quarter of this year). Following him are Dodge & Cox (26 million shares) and First Eagle Investment (Trades, Portfolio) (23.8 million shares). This chart shows guru buys and sells in recent quarters:

They must be buying for the future, for the next five to 10 years, since the current fundamentals provide nothing on which to base an investment. These GuruFocus tables show the mediocre states of National Oilwell Varco's financial strength and profitability:

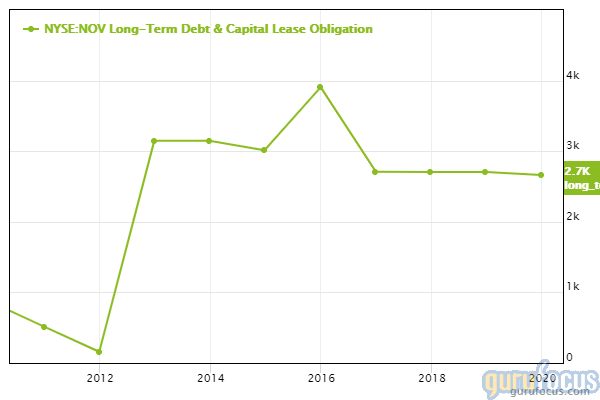

The weak financial rating reflects, in part, the company's leverage; this 10-year chart shows its long-term debt plus capital lease obligations:

The next chart, covering the past 24 years, shows how consistently National Oilwell Varco had been in generating earnings per share until it was clobbered in 2014:

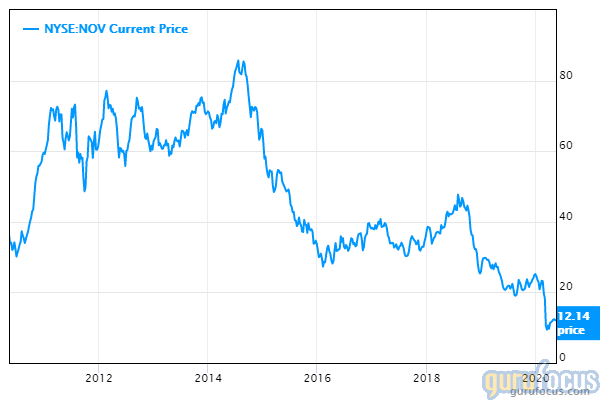

And this 10-year price chart reflects how investors reacted to the news coming out of National Oilwell Varco and the industry:

While National Oilwell Varco is part of the petroleum industry, it is not a producer, refiner or retailer. It describes itself in its 2019 10-K as "a leading independent provider of equipment and technology to the upstream oil and gas industry." Because it supplies the industry's upstream (exploration and production) sector, the company's revenues, and ultimately its returns, reflect the level of capital expenditures in the industry rather than oil prices. Of course, capex fluctuates with oil and gas prices.

The International Energy Agency had gloomy news in its April 2020 Oil Report: "Global capital expenditure by exploration and production companies in 2020 is forecast to drop by about 32% versus 2019 to $335 billion, the lowest level for 13 years."

However, the IEA concluded the report with more optimistic news for the longer term. It said, "There is clearly a long way to go before we can put the Covid-19 crisis behind us. However, we are encouraged by the solidarity shown by policy makers from producing and consuming countries working together to meet this historic challenge of bringing stability to the oil market."

In the May report, the agency saw less "demand destruction" because markets are doing what they are supposed to do. The agency noted: "It is on the supply side where market forces have demonstrated their power and shown that the pain of lower prices affects all producers. We are seeing massive cuts in output from countries outside the OPEC+ agreement and faster than expected."

National Oilwell Varco also had an optimistic forecast as it reported its first-quarter results. President and CEO Clay Williams wrote, "The current COVID-19 crisis is driving a historic drop in global demand for oil, which has resulted in the collapse of prices and forced unprecedented well shut-ins. While we find ourselves in what is likely to be one of the most severe downturns in our industry's 161-year history, NOV is well-positioned to weather the storm, with a strong balance sheet, ample liquidity, and a focus on cost control. We expect this downturn to get much worse during the second quarter, so we are intensifying our cost-cutting efforts to position NOV appropriately for the challenges ahead."

And, business goes on, albeit at a slower pace. In the earnings release, the company listed numerous achievements, including new products and contracts, as well as new technologies that will generate returns in the future. Among the contracts was one for a Japanese construction company building an offshore wind turbine installation vessel.

In conclusion, the gurus' positive interest in National Oilwell Varco has a logical basis. It comes out of a longer-term view of the industry and the company, one that sees a return to a more stable and profitable industry in the medium term. As we saw in the earnings per share chart above, the company had an excellent record for predictable returns in the first 18 years of its operations as a public company. That earnings record suggests a management team doing the right things when not bogged down by external circumstances.

Disclosure: I do not own shares in any companies named in this article and do not expect to buy any in the next 72 hours.

Read more here:

Shopify: Is This Rapid Grower a Value Stock?

Gentex: A Robust Dividend Stock

Dupont Is the Most Popular Stock Among the Gurus, but Why?

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.