Gurus' Worst-Performing Stocks

- By Tiziano Frateschi

While gurus hold positions in these companies, the stock prices and returns continue to fall. The following are the worst-performing stocks over the last three months with a long-term presence in more than four gurus' portfolios.

Warning! GuruFocus has detected 2 Warning Signs with GPS. Click here to check it out.

The intrinsic value of GPS

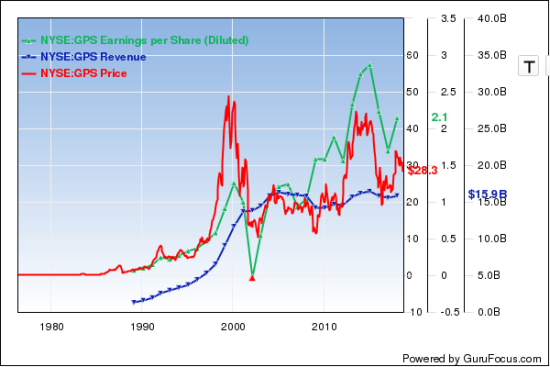

Gap Inc. (GPS) had a negative performance of 11.9% over the last six months. The stock is held by 13 gurus.

The apparel and accessories retailer has a $10.69 billion market cap. The stock is trading with a price-earnings ratio of 12.19. The current stock price of $27.8 is 22.09% below its 52-week high and 9.62% above its 52-week low. Over the past decade, it has returned a gain of 54%.

Over the last five years, its revenue has increased 4.30%, but its earnings per share fell 5.90%. The return on equity of 28.59% and return on assets of 11.45% are outperforming 87% of companies in the Global Apparel Stores industry.

The company's largest shareholder among the gurus is Pioneer Investments (Trades, Portfolio) with 0.73% of outstanding shares, followed by Steven Cohen (Trades, Portfolio) with 0.71% and Lee Ainslie (Trades, Portfolio) with 0.2%.

Hibbett Sports Inc. (HIBB) had a negative performance of 12.1% over the last six months. The stock is held by eight gurus.

The sporting goods retailer has a market cap of $369.27 million. The stock is trading with a price-earnings ratio of 10.31. The current stock price of $19.9 is 32.77% below its 52-week high and 57.94% above its 52-week low. Over the last 10 years, the price was almost flat with a decrease of just 2%.

Over the last five years, its revenue has increased 9.30%, but its earnings per share have fallen 6.30%. The return on equity of 11.47% and return on assets of 7.95% are outperforming 65% of companies in the Global Specialty Retail industry.

With 3.91% of outstanding shares, Ainslie is the company's largest guru shareholder, followed by Jim Simons (Trades, Portfolio) with 1.48% and Cohen with 0.72%.

Shutterfly Inc. (SFLY) had a negative performance of 18.3% over the last six months. The stock is held by 10 gurus.

The manufacturer of personalized greeting cards has a market cap of $2.3 billion. The stock is trading with a price-earnings ratio of 74.63. The current stock price of $68.66 is 31.57% below its 52-week high and 72.71% above its 52-week low. Over the past decade, it has returned a gain of 655%.

Over the last five years, the company's revenue has grown 16%. The return on equity of 6.22% and return on assets of 2.33% are underperforming 64% of companies in the Global Personal Services industry.

The company's largest shareholder among the gurus is PRIMECAP Management (Trades, Portfolio) with 14.75% of outstanding shares, followed by Ron Baron (Trades, Portfolio) with 2.99% and Simons with 2.84.

Teradata Corp. (TDC) had a negative performance of 7.7% over the last six months. Ten gurus hold the stock.

The provider of data analytics products has a market cap of $4.61 billion. The stock is trading with a forward price-earnings ratio of 25.45. The current stock price of $38.72 is 12.54% below its 52-week high and 21.88% above its 52-week low. Over the last 10 years, it has returned a gain of 84%.

Over the last five years, its revenue has increased 2.30%. The return on equity of -9.21% and return on assets of -2.72% are underperforming 84% of companies in the Global Data Storage industry.

With 14.21% of outstanding shares, First Eagle Investment (Trades, Portfolio) is the company's largest shareholder among the gurus, followed by Hotchkis & Wiley with 1.46% and Jeremy Grantham (Trades, Portfolio) with 1.1%.

State Street Corp. (STT) had a negative performance of 16.1% over the last six months. The stock is held by 24 gurus.

The financial holding company has a $33 billion market cap. The stock is trading with a price-earnings ratio of 14.67. The current stock price of $87 is 22.32% below its 52-week high and 7.69% above its 52-week low. Over the past decade, it has returned a gain of 67%.

Over the last five years, its revenue and earnings per share have grown 7.20% and 4.20%. While the return on equity of 10.13% is outperforming the sector, the return on assets of 1.01% is underperforming 65% of companies in the Global Asset Management industry.

The largest guru shareholder of the company is Bill Nygren (Trades, Portfolio) with 1.24% of outstanding shares, followed by Barrow, Hanley, Mewhinney & Strauss with 1.22%, the T Rowe Price Equity Income Fund (Trades, Portfolio) with 0.83% and Hotchkis & Wiley with 0.58%.

Synovus Financial Corp. (SNV) had a negative performance of 6.9% over the last six months. Seven gurus are invested in the stock.

The financial services company has a $5.59 billion market cap. The stock is trading with a price-earnings ratio of 17.26. The current stock price of $47.13 is 16.99% below its 52-week high and 9.36% above its 52-week low. Over the last 10 years, it has returned a loss of 37%.

Over the last five years, its revenue has climbed 5%, but its earnings per share fell 7%. The return on equity of 11% and return on assets of 1.09% are outperforming 63% of companies in the Global Banks - Regional - U.S. industry.

With 0.52% of outstanding shares, Richard Pzena (Trades, Portfolio) is the company's largest guru shareholder, followed by Private Capital (Trades, Portfolio) with 0.18% and Ainslie with 0.15%.

Disclosure: I do not own any stocks mentioned in this article.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 2 Warning Signs with GPS. Click here to check it out.

The intrinsic value of GPS