If You Had Bought Arconic (NYSE:ARNC) Shares A Year Ago You'd Have Earned 235% Returns

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Arconic Corporation (NYSE:ARNC) share price has soared 235% return in just a single year. Also pleasing for shareholders was the 13% gain in the last three months. But this could be related to the strong market, which is up 9.6% in the last three months. We'll need to follow Arconic for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Check out our latest analysis for Arconic

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last twelve months Arconic went from profitable to unprofitable. While this may prove temporary, we'd consider it a negative, so we would not have expected to see the share price up. It may be that the company has done well on other metrics.

Arconic's revenue actually dropped 22% over last year. So the fundamental metrics don't provide an obvious explanation for the share price gain.

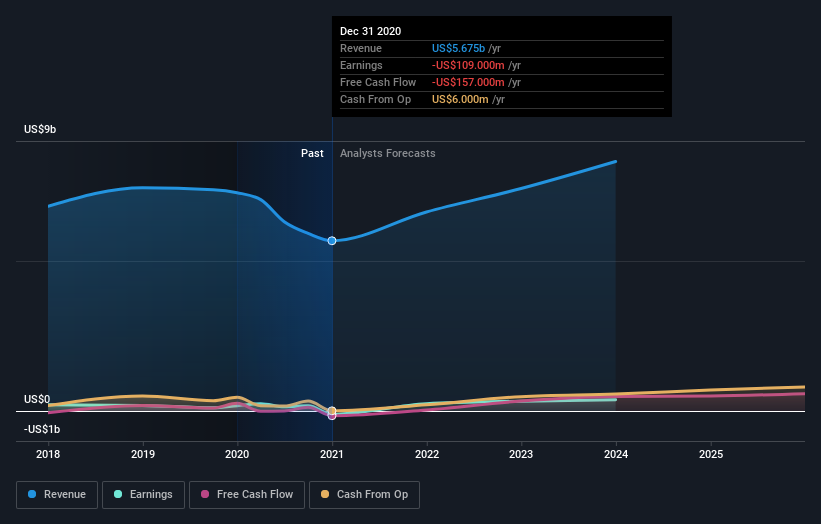

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. You can see what analysts are predicting for Arconic in this interactive graph of future profit estimates.

A Different Perspective

It's nice to see that Arconic shareholders have gained 235% over the last year. The more recent returns haven't been as impressive as the longer term returns, coming in at just 13%. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Arconic is showing 1 warning sign in our investment analysis , you should know about...

Arconic is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.