If You Had Bought Bakkavor Group (LON:BAKK) Stock A Year Ago, You Could Pocket A 77% Gain Today

If you want to compound wealth in the stock market, you can do so by buying an index fund. But you can significantly boost your returns by picking above-average stocks. To wit, the Bakkavor Group plc (LON:BAKK) share price is 77% higher than it was a year ago, much better than the market return of around 26% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! On the other hand, longer term shareholders have had a tougher run, with the stock falling 25% in three years.

View our latest analysis for Bakkavor Group

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year, Bakkavor Group actually saw its earnings per share drop 7.7%.

So we don't think that investors are paying too much attention to EPS. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

Bakkavor Group's revenue actually dropped 4.9% over last year. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

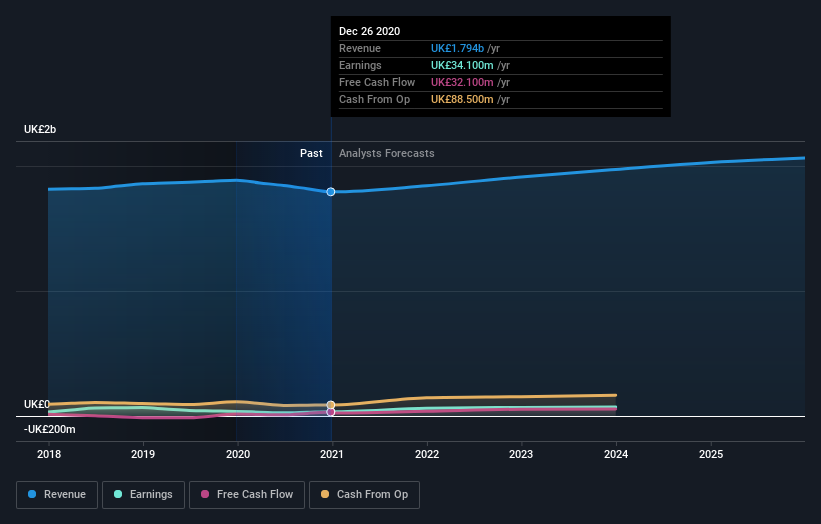

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What about the Total Shareholder Return (TSR)?

We've already covered Bakkavor Group's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Bakkavor Group's TSR of 83% over the last year is better than the share price return.

A Different Perspective

Pleasingly, Bakkavor Group's total shareholder return last year was 83%. What is absolutely clear is that is far preferable to the dismal 6% average annual loss suffered over the last three years. It could well be that the business has turned around -- or else regained the confidence of investors. It's always interesting to track share price performance over the longer term. But to understand Bakkavor Group better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Bakkavor Group you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.