If You Had Bought Chimera Investment (NYSE:CIM) Shares Three Years Ago You'd Have Made 25%

Buying a low-cost index fund will get you the average market return. But if you invest in individual stocks, some are likely to underperform. That's what has happened with the Chimera Investment Corporation (NYSE:CIM) share price. It's up 25% over three years, but that is below the market return. Zooming in, the stock is up just 3.1% in the last year.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

See our latest analysis for Chimera Investment

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

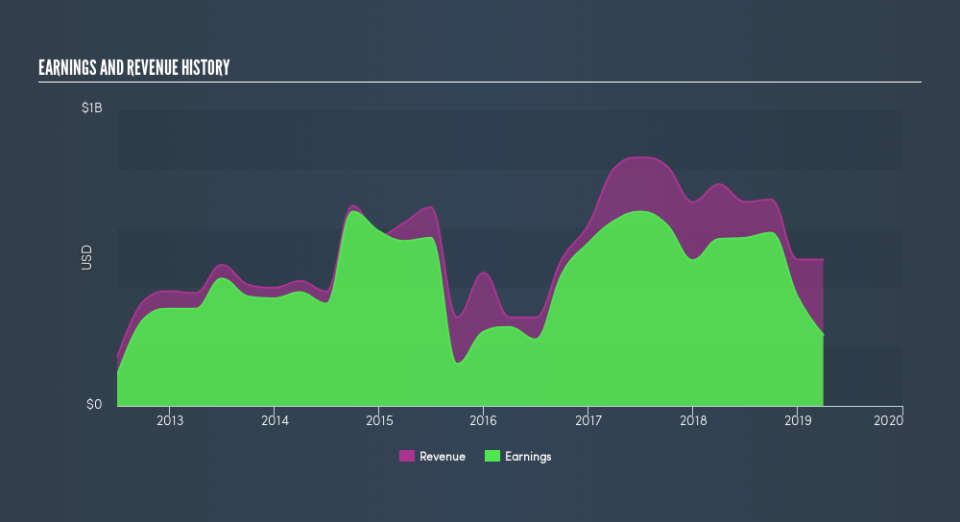

During the three years of share price growth, Chimera Investment actually saw its earnings per share (EPS) drop 2.1% per year. Companies are not always focussed on EPS growth in the short term, and looking at how the share price has reacted, we don't think EPS is the most important metric for Chimera Investment at the moment. Therefore, it makes sense to look into other metrics.

Interestingly, the dividend has increased over time; so that may have given the share price a boost. It could be that the company is reaching maturity and dividend investors are buying for the yield. On top of that, revenue grew at a rate of 10% per year, and it's likely investors interpret that as pointing to a brighter future.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

This free interactive report on Chimera Investment's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Chimera Investment, it has a TSR of 74% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Chimera Investment shareholders have received a total shareholder return of 15% over the last year. And that does include the dividend. However, the TSR over five years, coming in at 17% per year, is even more impressive. Importantly, we haven't analysed Chimera Investment's dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

But note: Chimera Investment may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.