If You Had Bought Golden Bull (NASDAQ:BTBT) Shares A Year Ago You'd Have Earned713% Returns

For many, the main point of investing in the stock market is to achieve spectacular returns. When you find (and hold) a big winner, you can markedly improve your finances. In the case of Golden Bull Limited (NASDAQ:BTBT), the share price is up an incredible 713% in the last year alone. On top of that, the share price is up 246% in about a quarter. We'll need to follow Golden Bull for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

It really delights us to see such great share price performance for investors.

View our latest analysis for Golden Bull

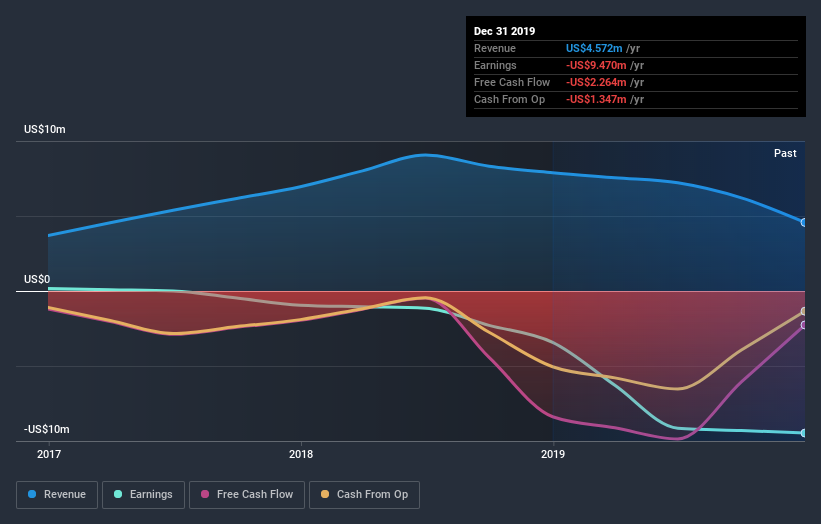

Given that Golden Bull didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Golden Bull actually shrunk its revenue over the last year, with a reduction of 42%. So it's very confusing to see that the share price gained a whopping 713%. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. While this gain looks like speculative buying to us, sometimes speculation pays off.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Golden Bull's financial health with this free report on its balance sheet.

A Different Perspective

Golden Bull shareholders should be happy with the total gain of 713% over the last twelve months. A substantial portion of that gain has come in the last three months, with the stock up 246% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Golden Bull has 5 warning signs (and 3 which are a bit unpleasant) we think you should know about.

But note: Golden Bull may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.