If You Had Bought Liberty TripAdvisor Holdings (NASDAQ:LTRP.A) Shares A Year Ago You'd Have Earned 183% Returns

Liberty TripAdvisor Holdings, Inc. (NASDAQ:LTRP.A) shareholders have seen the share price descend 18% over the month. Despite this, the stock is a strong performer over the last year, no doubt about that. Indeed, the share price is up an impressive 183% in that time. So it may be that the share price is simply cooling off after a strong rise. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

See our latest analysis for Liberty TripAdvisor Holdings

Liberty TripAdvisor Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Liberty TripAdvisor Holdings saw its revenue shrink by 69%. We're a little surprised to see the share price pop 183% in the last year. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. It's quite likely the revenue fall was already priced in, anyway.

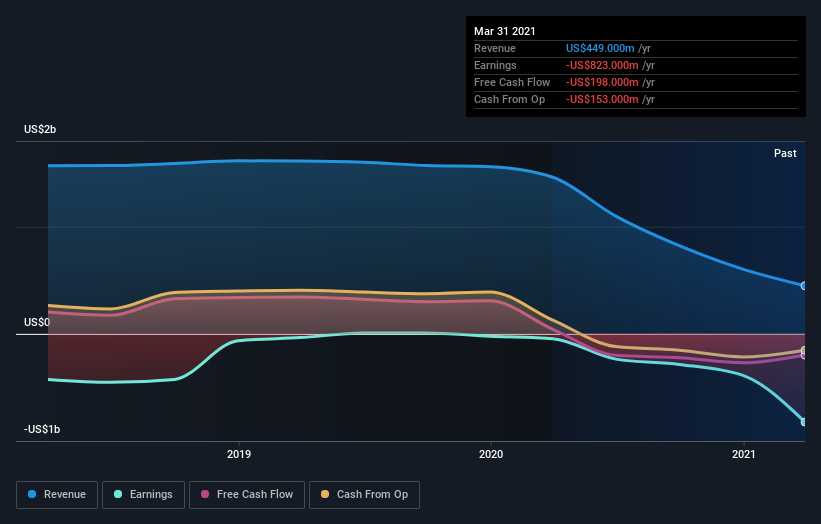

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that Liberty TripAdvisor Holdings shareholders have received a total shareholder return of 183% over the last year. There's no doubt those recent returns are much better than the TSR loss of 12% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Liberty TripAdvisor Holdings is showing 2 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.