If You Had Bought Virco Mfg (NASDAQ:VIRC) Shares Five Years Ago You'd Have Made 114%

When you buy a stock there is always a possibility that it could drop 100%. But on a lighter note, a good company can see its share price rise well over 100%. For instance, the price of Virco Mfg. Corporation (NASDAQ:VIRC) stock is up an impressive 114% over the last five years. On top of that, the share price is up 13% in about a quarter. But this move may well have been assisted by the reasonably buoyant market (up 11% in 90 days).

View our latest analysis for Virco Mfg

Given that Virco Mfg didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Virco Mfg saw its revenue grow at 4.8% per year. Put simply, that growth rate fails to impress. So we wouldn't have expected to see the share price to have lifted 16% for each year during that time, but that's what happened. While we wouldn't be overly concerned, it might be worth checking whether you think the fundamental business gains really justify the share price action. Some might suggest that the sentiment around the stock is rather positive.

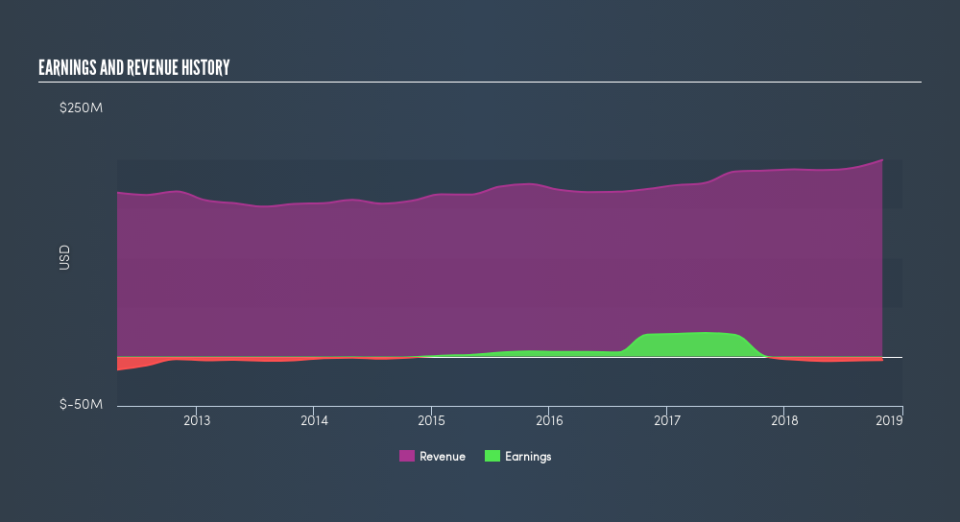

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

Balance sheet strength is crucual. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Virco Mfg the TSR over the last 5 years was 118%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Virco Mfg shareholders gained a total return of 10% during the year. But that return falls short of the market. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 17% over five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.