If You Had Bought Wix.com (NASDAQ:WIX) Stock Five Years Ago, You Could Pocket A 962% Gain Today

While Wix.com Ltd. (NASDAQ:WIX) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 20% in the last quarter. But over five years returns have been remarkably great. In fact, during that period, the share price climbed 962%. Impressive! Arguably, the recent fall is to be expected after such a strong rise. The most important thing for savvy investors to consider is whether the underlying business can justify the share price gain.

We love happy stories like this one. The company should be really proud of that performance!

Check out our latest analysis for Wix.com

Wix.com wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Wix.com saw its revenue grow at 31% per year. Even measured against other revenue-focussed companies, that's a good result. Fortunately, the market has not missed this, and has pushed the share price up by 60% per year in that time. It's never too late to start following a top notch stock like Wix.com, since some long term winners go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

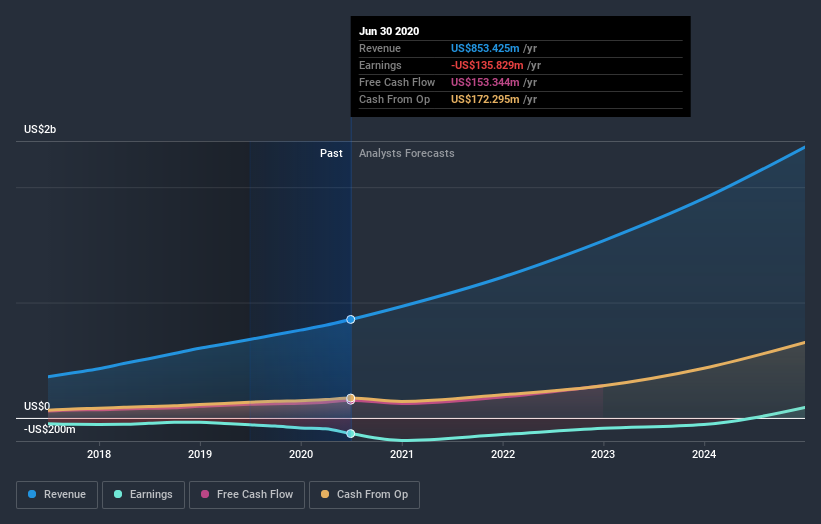

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. You can see what analysts are predicting for Wix.com in this interactive graph of future profit estimates.

A Different Perspective

It's good to see that Wix.com has rewarded shareholders with a total shareholder return of 93% in the last twelve months. That's better than the annualised return of 60% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Wix.com you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.