Harley-Davidson (HOG) to Post Q4 Earnings: What's in Store?

Harley-Davidson Inc. HOG is slated to release fourth-quarter and full-year 2020 results on Feb 2, before the bell. The Zacks Consensus Estimate for the quarter’s earnings is pegged at 10 cents.

Highlights of Q3 Earnings

Harley-Davidson delivered the strongest third-quarter net income since 2015 in the last reported quarter, reflecting initial positive impacts of The Rewire efforts. Importantly, the iconic motorcycle manufacturer posted better-than-expected results in the last reported quarter on higher-than-anticipated revenues from the Motorcycles and Related Products segment and the Financial Services segment.

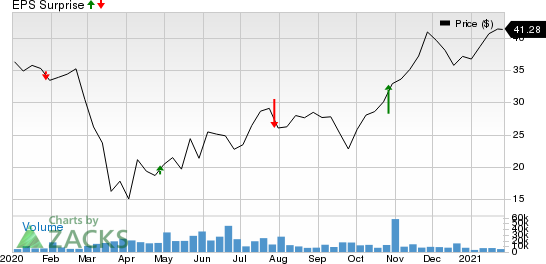

However, over the trailing four quarters, Harley-Davidson beat earnings estimates on three occasions and missed in the other, the average negative surprise being 188.24%. This is depicted in the graph below:

HarleyDavidson, Inc. Price and EPS Surprise

HarleyDavidson, Inc. price-eps-surprise | HarleyDavidson, Inc. Quote

Trend in Estimate Revisions

The Zacks Consensus Estimate for Harley-Davidson’s fourth-quarter earnings per share has remained unrevised in the past 60 days. Nonetheless, it compares favorably with the year-earlier quarter’s earnings of 9 cents per share, indicating a year-over-year rise of 11.11%. However, the Zacks Consensus Estimate for quarterly revenues suggests a year-over-year decline of 7.56%.

Earnings Whispers

Our proven Zacks model does not conclusively predict an earnings beat for Harley-Davidson this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, that is not the case here as elaborated below.

Earnings ESP: Harley-Davidson has an Earnings ESP of -20%. This is because the Most Accurate Estimate is pegged two cents lower than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Harley-Davidson currently flaunts a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Factors at Play

Harley-Davidson has been facing challenging demographic trends for the past few years, as its core audience grows past the age at which people generally buy motorcycles. As the company lacks youth appeal and a fewer people are riding motorcycles, sales of Harley Davidson have been adversely impacted. Also, with the economy not in a very good shape and the second wave of coronavirus cases picking up pace in the United States, the motorcycle maker might have witnessed declines in sales and earnings during the to-be-reported quarter.

In fact, the Zacks Consensus estimate for revenues from the Motorcycles and Related Products segment is pegged at $808 million for the December-end quarter, suggesting a decrease from the $874 million reported in the year-ago period. Further, the consensus estimate for revenues from the Financial Services segment is pinned at $194 million for the to-be-reported quarter, indicating a decline from the prior-year period’s $198 million.

Moreover, the consensus mark for total worldwide retail sales is pegged at 35,217 units for the fourth quarter, calling for a 9.1% decrease on a year-over-year basis.

Nonetheless, Harley-Davidson’s fourth-quarter 2020 performance is anticipated to have benefited from the successful completion of ‘The Rewire’ turnaround plan. The plan restructured the company’s operating model, reducing complexity and improving efficiency across all functions. It also got rid of overlapping efforts across operations worldwide, thus resulting in enormous savings in the expected selling, general and administration (SG&A) expenses. Markedly, the firm projects 2020 cash savings of $250 million under the Rewire plan.

All in all, while a sales decline is feared to have dented quarterly revenues, the triumph made across The Rewire strategy is likely to have provided some solace to the company’s cash flows and margins.

Stocks With Favorable Combinations

Here are a few stocks worth considering, as these have the right combination of elements to come up with an earnings beat this time around:

Ford F has an Earnings ESP of +11.11% and flaunts a Zacks Rank #1 at present. The company will announce fourth-quarter 2020 results on Feb 4.

AutoNation AN has an Earnings ESP of +1.91% and carries a Zacks Rank #3, currently. The company is scheduled to report quarterly numbers on Feb 16.

Magna International MGA has an Earnings ESP of +8.42% and currently flaunts a Zacks Rank of 1. The company is slated to release fourth-quarter numbers on Feb 19.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

AutoNation, Inc. (AN) : Free Stock Analysis Report

Magna International Inc. (MGA) : Free Stock Analysis Report

HarleyDavidson, Inc. (HOG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research