Hedge Funds Are Cashing Out Of Centene Corporation (CNC)

As we already know from media reports and hedge fund investor letters, hedge funds delivered their best returns in a decade. Most investors who decided to stick with hedge funds after a rough 2018 recouped their losses by the end of the fourth quarter of 2019. A significant number of hedge funds continued their strong performance in 2020 and 2021 as well. We get to see hedge funds' thoughts towards the market and individual stocks by aggregating their quarterly portfolio movements and reading their investor letters. In this article, we will particularly take a look at what hedge funds think about Centene Corporation (NYSE:CNC).

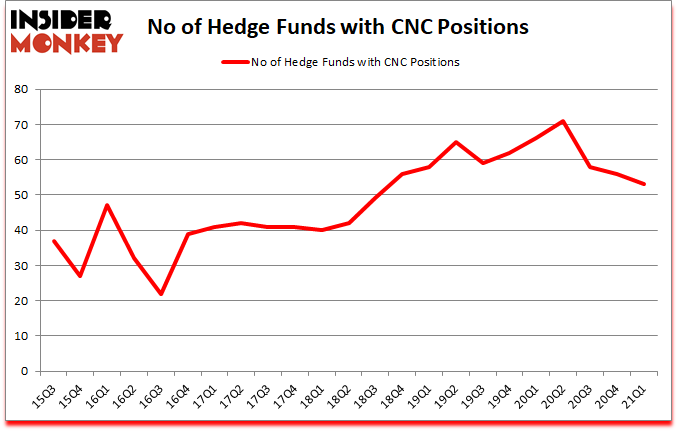

Centene Corporation (NYSE:CNC) was in 53 hedge funds' portfolios at the end of March. The all time high for this statistic is 71. CNC has seen a decrease in enthusiasm from smart money of late. There were 56 hedge funds in our database with CNC holdings at the end of December. Our calculations also showed that CNC isn't among the 30 most popular stocks among hedge funds (click for Q1 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey's monthly stock picks returned 206.8% since March 2017 and outperformed the S&P 500 ETFs by more than 115 percentage points (see the details here). That's why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Andreas Halvorsen of Viking Global

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, advertising technology one of the fastest growing industries right now, so we are checking out stock pitches like this under-the-radar adtech stock that can deliver 10x gains. We go through lists like the 10 best hydrogen fuel cell stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now let's take a peek at the latest hedge fund action surrounding Centene Corporation (NYSE:CNC).

Do Hedge Funds Think CNC Is A Good Stock To Buy Now?

At Q1's end, a total of 53 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -5% from one quarter earlier. On the other hand, there were a total of 66 hedge funds with a bullish position in CNC a year ago. So, let's review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Centene Corporation (NYSE:CNC) was held by Viking Global, which reported holding $701.5 million worth of stock at the end of December. It was followed by Farallon Capital with a $359.5 million position. Other investors bullish on the company included Lyrical Asset Management, Southpoint Capital Advisors, and Deerfield Management. In terms of the portfolio weights assigned to each position Courage Capital allocated the biggest weight to Centene Corporation (NYSE:CNC), around 5.68% of its 13F portfolio. Theleme Partners is also relatively very bullish on the stock, designating 3.5 percent of its 13F equity portfolio to CNC.

Seeing as Centene Corporation (NYSE:CNC) has experienced declining sentiment from the aggregate hedge fund industry, logic holds that there is a sect of money managers who sold off their full holdings last quarter. Interestingly, OrbiMed Advisors sold off the largest stake of the "upper crust" of funds tracked by Insider Monkey, comprising close to $119.7 million in stock. Ricky Sandler's fund, Eminence Capital, also dropped its stock, about $96.2 million worth. These transactions are interesting, as total hedge fund interest dropped by 3 funds last quarter.

Let's check out hedge fund activity in other stocks - not necessarily in the same industry as Centene Corporation (NYSE:CNC) but similarly valued. We will take a look at IQVIA Holdings, Inc. (NYSE:IQV), CRH PLC (NYSE:CRH), Mizuho Financial Group Inc. (NYSE:MFG), Carrier Global Corporation (NYSE:CARR), Canadian Natural Resources Limited (NYSE:CNQ), Match Group, Inc. (NASDAQ:MTCH), and Southwest Airlines Co. (NYSE:LUV). All of these stocks' market caps are closest to CNC's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position IQV,62,3683858,-7 CRH,9,165990,2 MFG,5,15835,0 CARR,51,2166831,-1 CNQ,29,528873,0 MTCH,68,2938465,-4 LUV,52,747041,-3 Average,39.4,1463842,-1.9 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 39.4 hedge funds with bullish positions and the average amount invested in these stocks was $1464 million. That figure was $2697 million in CNC's case. Match Group, Inc. (NASDAQ:MTCH) is the most popular stock in this table. On the other hand Mizuho Financial Group Inc. (NYSE:MFG) is the least popular one with only 5 bullish hedge fund positions. Centene Corporation (NYSE:CNC) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for CNC is 62.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 17.2% in 2021 through June 11th and still beat the market by 3.3 percentage points. Hedge funds were also right about betting on CNC as the stock returned 10.8% since the end of Q1 (through 6/11) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Get real-time email alerts: Follow Centene Corp (NYSE:CNC)

Disclosure: None. This article was originally published at Insider Monkey.

Follow Insider Monkey on Twitter

Related Content