Hedge Funds Have Never Been This Bullish On Synovus Financial Corp. (SNV)

At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

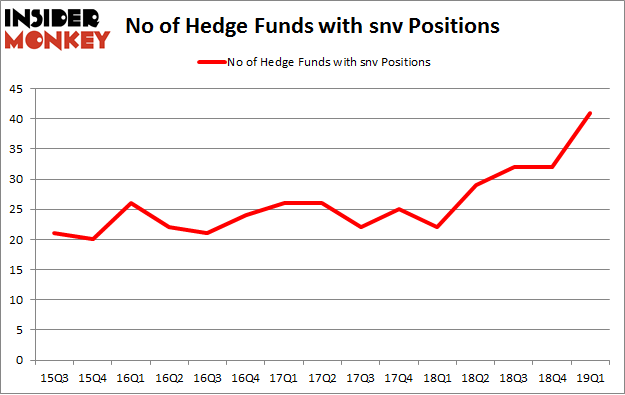

Synovus Financial Corp. (NYSE:SNV) was in 41 hedge funds' portfolios at the end of the first quarter of 2019. SNV has experienced an increase in enthusiasm from smart money lately. There were 32 hedge funds in our database with SNV holdings at the end of the previous quarter. Our calculations also showed that snv isn't among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey's flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That's why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We're going to take a peek at the key hedge fund action regarding Synovus Financial Corp. (NYSE:SNV).

What does the smart money think about Synovus Financial Corp. (NYSE:SNV)?

At the end of the first quarter, a total of 41 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 28% from the previous quarter. By comparison, 22 hedge funds held shares or bullish call options in SNV a year ago. So, let's check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Citadel Investment Group held the most valuable stake in Synovus Financial Corp. (NYSE:SNV), which was worth $165.7 million at the end of the first quarter. On the second spot was Millennium Management which amassed $124.2 million worth of shares. Moreover, Two Sigma Advisors, EJF Capital, and Azora Capital were also bullish on Synovus Financial Corp. (NYSE:SNV), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, key hedge funds have been driving this bullishness. Alyeska Investment Group, managed by Anand Parekh, assembled the most valuable position in Synovus Financial Corp. (NYSE:SNV). Alyeska Investment Group had $32.7 million invested in the company at the end of the quarter. Louis Bacon's Moore Global Investments also made a $27.5 million investment in the stock during the quarter. The other funds with brand new SNV positions are Mariko Gordon's Daruma Asset Management, Mario Gabelli's GAMCO Investors, and Paul Magidson, Jonathan Cohen. And Ostrom Enders's Castine Capital Management.

Let's now take a look at hedge fund activity in other stocks similar to Synovus Financial Corp. (NYSE:SNV). We will take a look at Ternium S.A. (NYSE:TX), Compania Cervecerias Unidas S.A. (NYSE:CCU), Cypress Semiconductor Corporation (NASDAQ:CY), and The New York Times Company (NYSE:NYT). All of these stocks' market caps match SNV's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position TX,12,81294,0 CCU,11,83289,2 CY,25,224543,2 NYT,32,1168693,0 Average,20,389455,1 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $389 million. That figure was $828 million in SNV's case. The New York Times Company (NYSE:NYT) is the most popular stock in this table. On the other hand Compania Cervecerias Unidas S.A. (NYSE:CCU) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Synovus Financial Corp. (NYSE:SNV) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately SNV wasn't nearly as popular as these 20 stocks and hedge funds that were betting on SNV were disappointed as the stock returned -3.8% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index