Hennessy Japan Small Cap Fund Buys 5 Stocks in 4th Quarter

- By Margaret Moran

The Hennessy Japan Small Cap Fund (Trades, Portfolio) recently disclosed the portfolio updates for its fourth quarter of fiscal 2020, which ended on Oct. 31.

Run by fund managers Tadahiro Fujimura and Takenari Okumura, the fund seeks long-term capital appreciation through equity investments in the Japanese companies that rank in the bottom 15% in terms of market cap. Some of the main things the fund considers when choosing investments include good management quality, earnings quality, balance sheet strength and attractive price for the value.

Based on the above criteria, the fund established five new positions during its fiscal fourth quarter: Nippon Flour Mills Co. Ltd. (TSE:2001), Poletowin Pitcrew Holdings Inc. (TSE:3657), Yoshimura Food Holdings KK (TSE:2884), NGK Spark Plug Co. Ltd. (TSE:5334) and Nichiha Corp. (TSE:7943).

Nippon Flour Mills

The fund took a new stake of 50,300 shares in Nippon Flour Mills, impacting the equity portfolio by 1.02%. During the quarter, shares traded for an average price of 1,703.11 Japanese yen ($16.58).

Founded in 1896, Nippon Flour Mills, also known as Nippn Corp., is a Japanese flour milling company. The vast majority of its revenue comes from milling flour and manufacturing simple products made with flour (such as noodles and frozen dough).

On Jan. 5, shares of Nippn traded around 1,615 yen for a market cap of 124.58 billion yen and a price-earnings ratio of 16.96. According to the GuruFocus Value chart, the stock is fairly valued.

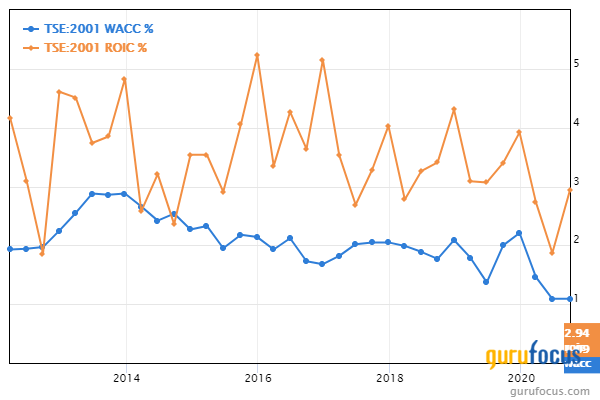

The company has a financial strength rating of 7 out of 10 and a profitability rating of 6 out of 10. The interest coverage ratio of 53.36 is higher than 77% of other companies in the industry, while the Altman Z-Score of 2.58 indicates the company is not likely in danger of bankruptcy. The return on invested capital is consistently higher than the weighted average cost of capital, meaning the company is creating value.

Poletowin Pitcrew Holdings

The fund also invested in 89,900 shares of Poletowin Pitcrew Holdings, impacting the equity portfolio by 0.99%. Shares traded for an average price of 956.22 yen during the quarter.

Poletowin Pitcrew Holdings is a tech testing and debugging company that operates through two main segments: "Testing/Verification & Evaluation Business," which debugs software and hardware, and "Internet Supporting Business," which detects fraud and provides censorship services.

On Jan. 5, shares of Poletowin traded around 1,157 yen for a market cap of 44.02 billion yen and a price-earnings ratio of 23.84. According to the GuruFocus Value chart, the stock is fairly valued.

The company has a financial strength rating of 9 out of 10 and a profitability rating of 7 out of 10. The Altman Z-Score of 9.15 indicates the company has a stable balance sheet and the cash-debt ratio of 53.05 is beating 78% of competitors. The operating margin of 14.03% and net margin of 9.28% are outperforming their respective industry medians.

Yoshimura Food Holdings

The fund picked up 75,100 shares of Yoshimura Food Holdings, impacting the equity portfolio by 0.76%. During the quarter, shares traded for an average price of 935.09 yen.

Through its network of subsidiaries, Yoshimura Food Holdings develops, produces and sells various food products such as noodles, processed ingredients, frozen foods and sake.

On Jan. 5, shares of Yoshimura traded around 775 yen for a market cap of 17.23 billion yen and a price-earnings ratio of 485.13. According to the GuruFocus Value chart, the stock could be a potential value trap as it is trading far below its intrinsic value estimate.

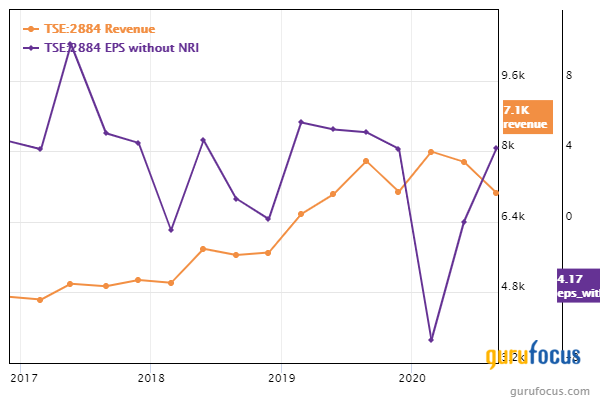

The company has a financial strength rating of 5 out of 10 and a profitability rating of 6 out of 10. The interest coverage ratio of 11.57 and Altman Z-Score of 2.51 are about average. While the three-year revenue growth rate is 21.3%, the recent earnings history has had its ups and downs, with earnings per share without non-recurring items decreasing an average of 21.4% per year over the past three years.

NGK Spark Plug

The fund established a holding of 26,900 shares in NGK Spark Plug, impacting the equity portfolio by 0.60%. Shares traded for an average price of 1,847.32 yen during the quarter.

NGK Spark Plug offers two aftermarket brands for internal combustion engines: NGK Spark Plug, which manufactures and sells spark plugs and other ignition parts, and NTK Technical Ceramics, which produces new ceramics.

On Jan. 5, shares of NGK Spark Plug traded around 1,756 yen for a market cap of 355.99 billion yen and a price-earnings ratio of 22.64. According to the GuruFocus Value chart, the stock is modestly undervalued.

The company has a financial strength rating of 4 out of 10 and a profitability rating of 6 out of 10. The Piotroski F-Score of 4 out of 9 is typical of a financially stable company, as is the Altman Z-Score of 2.06. The ROIC was below the WACC in quite a few of the recent quarters, though it seems the company returned to overall profitability in the most recent quarter.

Nichiha

The fund took a new stake worth 15,900 shares in Nichiha, impacting the equity portfolio by 0.58%. During the quarter, shares traded for an average price of 2,843.45 yen.

Nichiha operates in the construction industry, producing a range of high-performance fiber cement panels that resemble wood, stone, brick, metal and other materials for commercial and residential projects.

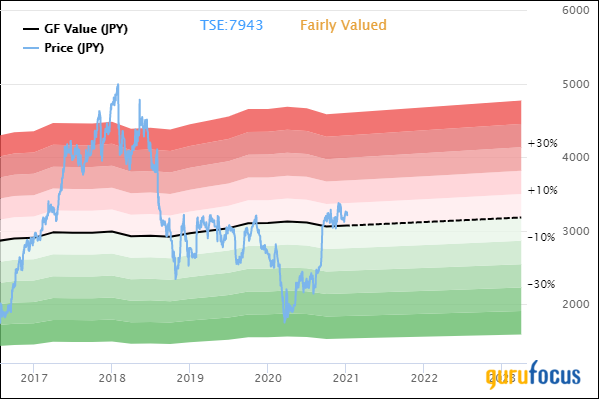

On Jan. 5, shares of Nichiha traded around 3,210 yen for a market cap of 118.99 billion yen and a price-earnings ratio of 12.99. According to the GuruFocus Value chart, the stock is fairly valued.

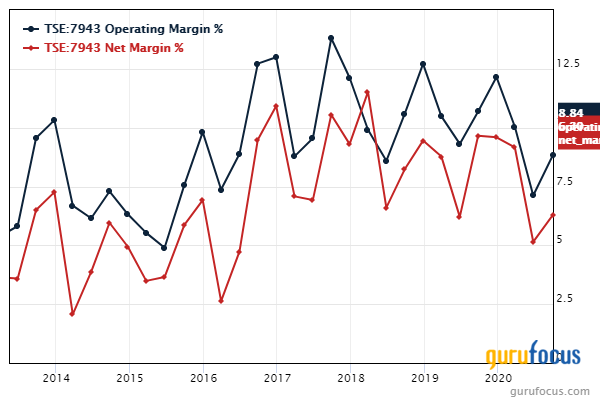

The company has a financial strength rating of 8 out of 10 and a profitability rating of 8 out of 10. The cash-debt ratio of 2.09 and interest coverage ratio of 108.5 are stronger than 70% of industry peers. Overall, the operating margin and net margin have been in an uptrend in recent years to their respective present values of 8.84% and 6.30%.

Portfolio overview

As of the quarter's end, the fund held common shares in 61 stocks valued at a total of $79 million. The turnover rate for the quarter was 5%.

The top holdings were EF-ON Inc. (TSE:9514) with 2.46% of the equity portfolio, HITO-Communications Holdings Inc. (TSE:4433) with 2.35% and Pacific Industrial Co. Ltd. (TSE:7250) with 2.32%. In terms of sector weighting, the fund was most invested in industrials, followed by technology and consumer cyclical.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research and/or consult registered investment advisors before taking action in the stock market.

Read more here:

3 Stocks That Outperformed the S&P 500 in 2020

The Most Profitable Clean Energy Stocks of 2020

Are Airline Stocks a Buy Following the Latest Bailout?

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.