Here's Why You Should Hold on to Robert Half (RHI) Stock

Robert Half International Inc. RHI carries an impressive Growth Score of B. This style score condenses all the essential metrics from the company’s financial statements to get a true sense of the quality and sustainability of its growth.

The company’s next five-year earnings growth is pegged at 2.7%.

Factors That Bode Well

Protiviti, the company’s subsidiary, through which it offers risk consulting, internal audit and information technology consulting services is strongly positioned in the market. The unit is currently a double-digit margin and revenue performer. Protiviti’s March end revenues came in at $294 million, up 16.5% year over year. Gross margin was $78 million or 26.3% of revenues.

Robert Half has been utilizing a major share of its capital expenditures on investments in software initiatives and technology infrastructure. This along with broad and deep client, candidate database, and network scope and global scale is likely to drive long-term growth for the company.

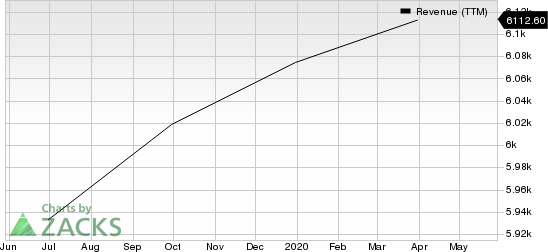

Robert Half International Inc. Revenue (TTM)

Robert Half International Inc. revenue-ttm | Robert Half International Inc. Quote

Risk Associated

Robert Half has a debt-laden balance sheet. Total debt at the end of first-quarter 2020 was $277 million, more than $274 million at the end of the prior quarter. The debt-to-capital ratio of 0.20 is higher than the previous quarter’s 0.19. An increase in debt-to-capitalization ratio indicates higher risk of insolvency.

Moreover, the company’s cash and cash equivalent of $250 million at the end of the first quarter was below this debt level. This underscores that the company doesn’t have enough cash to meet this debt burden. However, the cash level is adequate to clear the short-term debt of $72 million.

Zacks Rank and Stocks to Consider

Robert Half currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader Zacks Business Services sector are Elastic N.V. ESTC, SailPoint Technologies Holdings, Inc. SAIL and SPS Commerce, Inc. SPSC, each carrying a Zacks Rank #2(Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings (three to five years) growth rate for Elastic, SailPoint Technologies and SPS Commerce is estimated at 25.9%, 15% and 15%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SPS Commerce, Inc. (SPSC) : Free Stock Analysis Report

Robert Half International Inc. (RHI) : Free Stock Analysis Report

SailPoint Technologies Holdings, Inc. (SAIL) : Free Stock Analysis Report

Elastic N.V. (ESTC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research