Here's Why lululemon (LULU) is Well-Poised Amid Industry Woes

lululemon athletica inc. LULU has been on track with its five-year Power of Three plan, which aims at doubling sales in the men’s and digital categories, and quadrupling sales in the international unit by 2023. Encouraged by robust gains from the pandemic-led athleisure boom, lululemon recently announced its Power of Three ×2 growth strategy. It is also poised to gain from strength in its e-commerce business and rebound in brick-and-mortar sales.

Driven by improved trends across channels and regions, driven by robust traffic trends in both stores and e-commerce, lululemon posted earnings and sales beat in first-quarter fiscal 2022. Earnings beat estimates for the eighth straight quarter in first-quarter fiscal 2022. Its sales surpassed the Zacks Consensus Estimate after a miss reported in the prior quarter.

The results reflected continued momentum in its business, with a strong performance in North America. Total comparable sales improved 28% year over year and 29% on a constant-dollar basis. Comps were driven by robust traffic trends in both stores and e-commerce, with 40% traffic growth in both channels.

The Zacks Consensus Estimate for the Zacks Rank #3 (Hold) company’s current financial year’s sales and earnings suggests growth of 22.9% and 21.3%, respectively, from the year-ago period’s reported numbers.

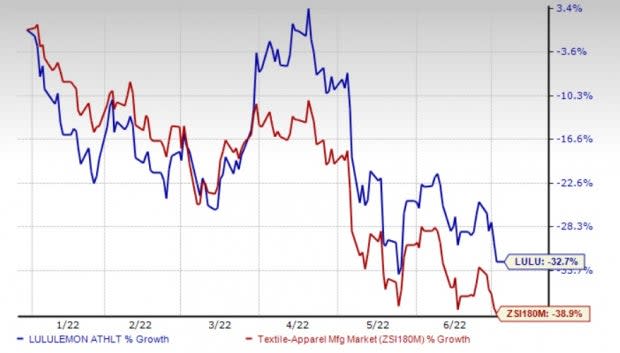

Although the company’s shares have lost 32.7% year to date, it fared better than the industry’s decline of 38.9%.

Image Source: Zacks Investment Research

Progress on Power of Three Plan

The five-year Power of Three Plan focuses on three core objectives — product innovation, augmenting omni-guest experiences and market expansion. The company is witnessing a positive consumer response to its merchandise. It remains optimistic about the innovations it plans to bring in its assortments for both men and women. Management plans to keep investing in strategies to maintain customer footfall, including efforts to augment the store base and enhance shopping experiences.

Driven by these plans, the company had earlier anticipated delivering sales growth in the low-teens in the next five years (ending 2023). lululemon also expects some annual benefits of this plan, which include modest gross margin improvement, a slight reduction in SG&A costs, operating growth in excess of sales growth, earnings per share growth equal to or more than operating income growth, and capital expenditure of 6-8% of sales.

Power of Three ×2 Growth Strategy

The Power of Three ×2 growth strategy is likely to double lululemon’s revenues from $6.25 billion in 2021 to $12.5 billion by 2026. The plan focuses on three key growth drivers, including product innovation, guest experiences and market expansion. The five-year plan is likely to quadruple international sales, along with doubling digital and menswear sales. Also, the women’s business and North America operations are each anticipated to witness a low-double-digit CAGR in revenues, with store channel growth in the mid-teens in the next five years. As part of its strategy, the company intends to expand in China as well as European markets, with plans to open stores in Spain and Italy.

For 2021-2026, the total net revenue CAGR is expected to be 15%, with a slight expansion in the operating margin on an annual basis. lululemon anticipates bottom-line growth to outpace revenue growth. Although the 2026 targets seem too bold, the company believes that these are achievable due to its strong financial position.

Robust Business Trends

lululemon witnessed a rebound in brick-and-mortar sales, driven by an increase in store traffic as consumers returned to stores for shopping. In the company’s store channel, sales increased 36% year over year and 13% on a three-year CAGR basis in the fiscal first quarter. Management highlighted that productivity was higher than the 2019 levels in first-quarter fiscal 2022 and continued to be at similar levels in the second quarter of fiscal 2022. Comparable store sales advanced 24% in the fiscal first quarter.

Lululemon expects to capture the growing online demand and ensure a robust shopping experience through its accelerated e-commerce investments. It has been investing in developing sites, building transactional omni functionality and increasing fulfillment capabilities.

The company continues to strengthen omni-channel capabilities such as curbside pickups, same-day deliveries and BOPUS (buy online pick up in store). It is enhancing its mobile app in a bid to offer the curbside pickup service and train its store associates to help customers speed up transactions. Free online digital educator service for people who can't make it into the company’s stores also bodes well.

In the first quarter of fiscal 2022, direct-to-consumer net revenues climbed 32% (up 33% on a constant-dollar basis). Direct-to-consumer net revenues accounted for 45% of the company’s total net revenues compared with 44% in the first quarter of fiscal 2021. The company’s e-commerce business delivered an impressive performance, with revenues increasing 51%, witnessing a three-year CAGR.

Upbeat View

Backed by the strong start to fiscal 2022, the company raised its guidance for fiscal 2022. It anticipates net revenues of $7.61-$7.71 billion compared with the prior mentioned $7.490-7.615 billion. The sales view assumes e-commerce growth in the high-teens to low-20s range compared with the second quarter of fiscal 2021. It also expects to see a three-year CAGR of 24-25%, which is higher than the 3-year revenue CAGR of 19% leading up to fiscal 2020.

For the fiscal year, LULU expects the SG&A rate to leverage 50-100 bps year over year, driven by increased sales and the shift in lululemon studio, MIRROR investments. The company expects the operating margin for fiscal 2022 to be flat with the last year, including higher air freight costs. Adjusted EPS for the fiscal year is envisioned to be $9.35-$9.50 compared with $9.15-$9.35 expected earlier. The company expects an effective tax rate of 28-25.5% for fiscal 2022.

For the second quarter of fiscal 2022, management anticipates net revenues of $1.75-$1.775 billion, indicating growth of 21-22%. It anticipates a relatively flat SG&A expense rate for the fiscal second quarter. Earnings per share are projected to be $1.82-$1.87 for the fiscal second quarter. Management’s EPS guidance excludes the gain of 7 cents per share on a real estate sale, which is expected to be realized in the fiscal second quarter.

Headwinds on the Path

lululemon continues to grapple with delays across the supply chain, mainly with regard to transporting its products through ocean freight. Incidentally, management is more heavily dependent on air freight. The ongoing supply-chain issues and trimmed air freight capacity not only induced delays but also resulted in increased freight costs. These factors affected the company’s gross margin in first-quarter fiscal 2022. Elevated investments, pertaining to corporate SG&A and depreciation, have been resulting in higher SG&A expenses.

The company anticipates a gross margin decline of 100-150 bps for fiscal 2022 compared with a 50-100 bps decline mentioned earlier. The decline is expected to result from higher investments in the distribution center network and an increase in content development costs for lululemon studio, MIRROR.

Higher costs and the gross margin decline will be partly offset by lower digital marketing, which is likely to get reflected in SG&A. The company anticipates air freight costs to hurt the gross margin by a modest 30 bps compared with the flat air freight costs mentioned earlier.

Looking for Better-Ranked Stocks? Check These

We have highlighted three better-ranked companies in the same industry, namely GIII Apparel Group GIII, Oxford Industries OXM and Crocs CROX.

GIII Apparel currently flaunts a Zacks Rank #1 (Strong Buy). GIII has a trailing four-quarter earnings surprise of 97.5%, on average. Shares of GIII have declined 27.6% year to date. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GIII Apparel's current financial-year sales and earnings suggests growth of 12.9% and 10.4%, respectively, from the year-ago period's reported figures.

Oxford Industries currently sports a Zacks Rank of 1. OXM has a trailing four-quarter earnings surprise of 99.7%, on average. Shares of OXM have declined 13.8% in the year-to-date period.

The Zacks Consensus Estimate for Oxford Industries’ current financial year’s sales and EPS suggests growth of 14.5% and 23.7%, respectively, from the year-ago period's reported numbers.

Crocs carries a Zacks Rank #2 (Buy) at present. Shares of CROX have declined 62.6% year to date. The company has a trailing four-quarter earnings surprise of 26.5%, on average. The company has a long-term earnings growth rate of 15%.

The Zacks Consensus Estimate for Crocs’ current-year sales and EPS suggests growth of 52.6% and 26.9%, respectively, from the year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

GIII Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Oxford Industries, Inc. (OXM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research