Here's Why We Think Kirloskar Brothers (NSE:KIRLOSBROS) Is Well Worth Watching

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Kirloskar Brothers (NSE:KIRLOSBROS), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Check out our latest analysis for Kirloskar Brothers

How Quickly Is Kirloskar Brothers Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. Over the last three years, Kirloskar Brothers has grown EPS by 6.5% per year. While that sort of growth rate isn't amazing, it does show the business is growing.

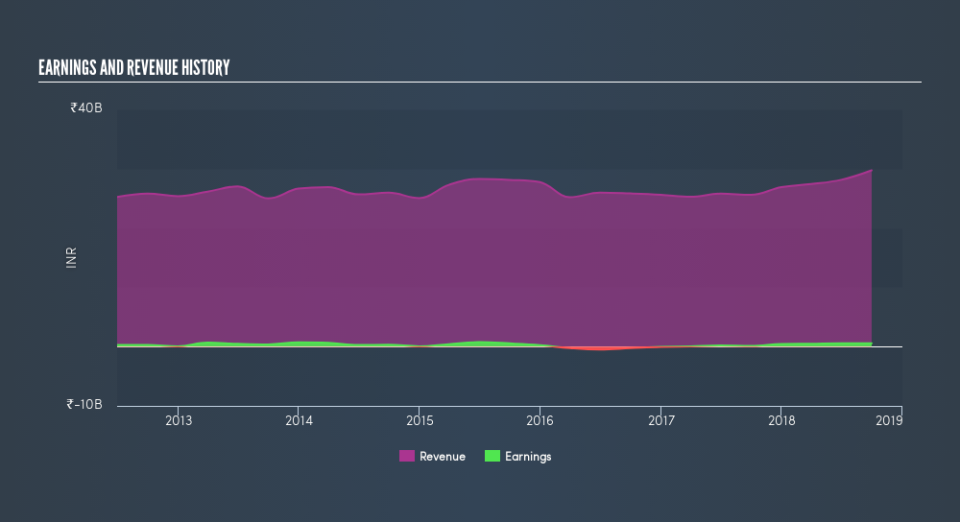

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Kirloskar Brothers's EBIT margins were flat over the last year, revenue grew by a solid 16% to ₹30b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Kirloskar Brothers isn't a huge company, given its market capitalization of ₹13b. That makes it extra important to check on its balance sheet strength.

Are Kirloskar Brothers Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One shining light for Kirloskar Brothers is the serious outlay one insider has made to buy shares, in the last year. In one fell swoop, Chairman & MD Sanjay Kirloskar, spent ₹83m, at a price of ₹272 per share. Big insider buys like that are almost as rare as an ocean free of single use plastic waste.

On top of the insider buying, we can also see that Kirloskar Brothers insiders own a large chunk of the company. Actually, with 42% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. With that sort of holding, insiders have about ₹5.3b riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Should You Add Kirloskar Brothers To Your Watchlist?

As I already mentioned, Kirloskar Brothers is a growing business, which is what I like to see. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of Kirloskar Brothers.

As a growth investor I do like to see insider buying. But Kirloskar Brothers isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.