Here's Why it is Wise to Retain Vornado Realty (VNO) Stock Now

Vornado Realty Trust VNO is well-poised to benefit from the improving office leasing market on the back of high-quality assets in key locations. However, stiff competition and the prevalent choppiness in the retail real estate market remain worrisome.

Amid significant government stimulus and improvement in conditions in the office leasing market, the company is likely to benefit from the emerging trend, given its ability to offer top-quality office spaces.

Its focus on having assets in a few select high-rent, high-barrier-to-entry geographic markets and a diversified tenant base, which includes several industry bellwethers, are expected to drive steady cash flows and fuel its growth over the long term.

The REIT is making developments and divestitures in addition to business spin-offs. Strategic sell-outs provide Vornado with the dry powder to reinvest in developments and redevelopments. In August, it signed agreements to sell five Manhattan retail properties for $184.5 million. The properties witnessed negative income and street-level occupancy of nearly 30%. Timely portfolio-repositioning initiatives will drive its growth over the long term.

Vornado enjoys a strong balance sheet position and has ample liquidly. As of Jun 30, 2021, the company had $4.5 billion in liquidity, consisting of $2.3 billion of cash and cash equivalents. Such a flexible financial position will enable it to take advantage of investment opportunities and fund its development projects.

However, the company faces intense competition from developers, owners and operators of office properties and other commercial real estate. This affects the company’s ability to attract and retain tenants at relatively higher rents than its competitors, thereby, affecting its profitability.

Moreover, its retail portfolio is suffering from the decline in foot traffic, store closures and retailer bankruptcies. Also, the retail tenants continue to be affected by economic conditions and other factors, including the limitations on international travel.

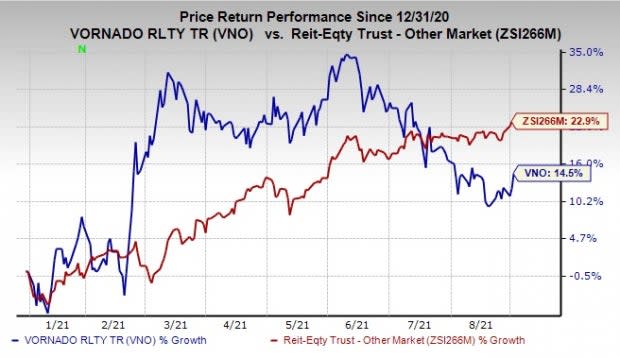

Shares of this Zacks Rank #3 (Hold) company have appreciated 14.5% year to date, underperforming the industry’s growth of 22.9%. However, the trend in estimate revisions for 2021 funds from operations (FFO) per share indicates a favorable outlook for the company as it has moved marginally north in the past 30 days.

Image Source: Zacks Investment Research

Key Picks

The Zacks Consensus Estimate for Arbor Realty Trust’s ABR ongoing year’s FFO per share has been raised 7.5% over the past month. The company carries a Zacks Rank of 2 (Buy), currently. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for CubeSmart’s CUBE 2021 FFO per share has moved 1% upward in the past week. The company currently carries a Zacks Rank of 2.

The Zacks Consensus Estimate for Extra Space Storage Inc.’s EXR current-year FFO per share has moved marginally north in the past week. The company carries a Zacks Rank of 2 at present.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vornado Realty Trust (VNO) : Free Stock Analysis Report

Extra Space Storage Inc (EXR) : Free Stock Analysis Report

CubeSmart (CUBE) : Free Stock Analysis Report

Arbor Realty Trust (ABR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research