Hexo Corp. (HEXO) to Post Q3 Earnings: What's in the Offing?

Hexo Corp. HEXO is scheduled to release third-quarter fiscal 2020 results on Jun 11, before the closing bell.

In the last reported quarter, the company delivered a positive earnings surprise of 33.3%.

Q3 Estimates

The Zacks Consensus Estimate for the company’s fiscal third-quarter loss is pegged at 5 cents per share. The same for revenues is pegged at $14.2 million, indicating growth of 18.5% from the prior-year reported figure.

Factors to Note

Hexo has been witnessing a substantial shift in the capital markets and the capability of cannabis companies to issue equity. Given this shift, Hexo has been taking steps to rationalize its operations.

The company has been completing capital projects that are likely to position it as a leader in the Canadian marketplace. Further, the company has been launching automation and implementing processes and procedures that will bolster efficiency of those operations. Further, Hexo has been utilizing new analytical tools to produce and sell products with the present customer demand in mind.

These steps might have positively impacted the company’s performance in the to-be-reported quarter.

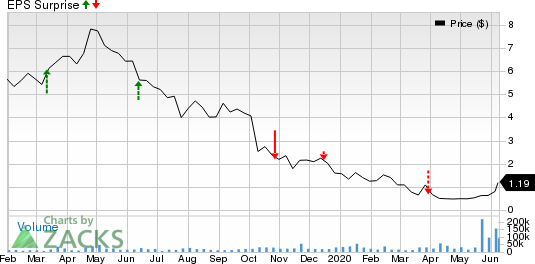

HEXO Corp. Price and EPS Surprise

HEXO Corp. price-eps-surprise | HEXO Corp. Quote

Moreover, the company may have continued its aggressive pricing strategy in order to enhance its adult use market share in Canada and across its other products to lower product returns through Original Stash. This, in turn, is likely to get reflected in the fiscal third-quarter results.

Further, Hexo’s to-be-reported quarter’s results are likely to reflect introduction of products in the form of vapes, concentrates, chocolates, gummies.

Despite the structural changes made to its business, the company’s operations continue to gain efficiency and improve output. This is anticipated to get reflected in the fiscal third-quarter results.

However, stiff competition in the cannabis market might have weighed on the company’s overall performance in the fiscal third quarter.

What Our Quantitative Model Suggests

Per our proven model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. This is not the case here as you will see.

Earnings ESP: Hexo has an Earnings ESP of -55.56%. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Zacks Rank: It carries a Zacks Rank #2.

Key Picks

Some other top-ranked stocks in the broader medical space that have already announced their quarterly results include Aphria Inc. APHA, Biogen Inc. BIIB and Eli Lilly and Company LLY.

Aphria reported third-quarter fiscal 2020 adjusted EPS of 2 cents, beating the Zacks Consensus Estimate of a loss of 4 cents. Net revenues of $64.4 million surpassed the consensus mark by 14.6%. The company carries a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Biogen currently carries a Zacks Rank #2. It reported first-quarter 2020 adjusted EPS of $9.14, outpacing the Zacks Consensus Estimate by 18.1%. Revenues of $3.53 billion outpaced the consensus mark by 3.2%.

Eli Lilly reported first-quarter 2020 EPS of $1.75, outpacing the Zacks Consensus Estimate by 12.9%. Revenues of $145.3 million surpassed the consensus estimate by 6.3%. The company currently sports a Zacks Rank #1.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Aphria Inc. (APHA) : Free Stock Analysis Report

HEXO Corp. (HEXO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research