Is Hilltop Holdings Inc (NYSE:HTH) Expensive For A Reason? A Look At The Intrinsic Value

Pricing HTH, a financial stock, can be difficult since these banks have cash flows that are affected by regulations that are not imposed upon other sectors. For example, banks are required to hold more capital to reduce the risk to depositors. Looking at line items like book values, in addition to the return and cost of equity, may be practical for evaluating HTH’s value. Below we’ll take a look at how to value HTH in a reasonably useful and easy approach. View our latest analysis for Hilltop Holdings

What Model Should You Use?

There are two facets to consider: regulation and type of assets. Strict regulatory environment in United States’s finance industry reduces HTH’s financial flexibility. In addition to this, banks generally don’t hold substantial portions of physical assets on their books. The Excess Returns model overcomes the required capital kept on hand and lack of tangibles by focusing on forecasting stable earnings, rather than less relevant factors such as depreciation and capex, which more traditional models focus on.

Calculating HTH’s Value

The key belief for Excess Returns is that equity value is how much the firm can earn, over and above its cost of equity, given the level of equity it has in the company at the moment. The returns above the cost of equity is known as excess returns:

Excess Return Per Share = (Stable Return On Equity – Cost Of Equity) (Book Value Of Equity Per Share)

= (8.25% – 9.77%) * $22.5 = $-0.34

Excess Return Per Share is used to calculate the terminal value of HTH, which is how much the business is expected to continue to generate over the upcoming years, in perpetuity. This is a common component of discounted cash flow models:

Terminal Value Per Share = Excess Return Per Share / (Cost of Equity – Expected Growth Rate)

= $-0.34 / (9.77% – 2.47%) = $-4.7

Combining these components gives us HTH’s intrinsic value per share:

Value Per Share = Book Value of Equity Per Share + Terminal Value Per Share

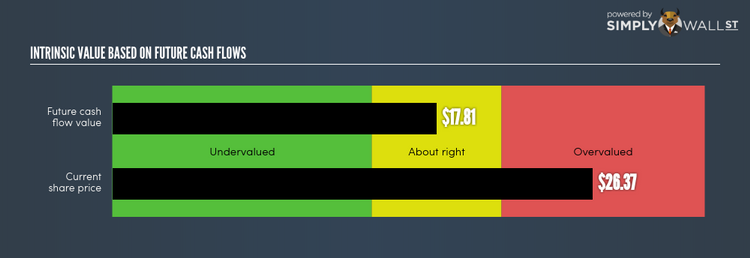

= $22.5 + $-4.7 = $17.81

Given HTH’s current share price of $26.37, HTH is , at this time, overvalued. Therefore, there’s no benefit to buying HTH today. Pricing is only one aspect when you’re looking at whether to buy or sell HTH. Fundamental factors are key to determining if HTH fits with the rest of your portfolio holdings.

Next Steps:

For banks, there are three key aspects you should look at:

1. Financial health: Does it have a healthy balance sheet? Take a look at our free bank analysis with six simple checks on things like bad loans and customer deposits.

2. Future earnings: What does the market think of HTH going forward? Our analyst growth expectation chart helps visualize HTH’s growth potential over the upcoming years.

3. Dividends: Most people buy financial stocks for their healthy and stable dividends. Check out whether HTH is a dividend Rockstar with our historical and future dividend analysis.

For more details and sources, take a look at our full calculation on HTH here.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.