Honeywell (HON) Tops Q2 Earrings on Operational Excellence

Honeywell International Inc. HON reported better-than-expected results for second-quarter 2018.

Earnings & Revenues

Adjusted earnings in the reported quarter came in at $2.12 per share, outpacing the Zacks Consensus Estimate of $2.01. The bottom line also improved 18% year over year. This upside primarily stemmed from the company’s stellar operational performance during the quarter.

Revenues of $10,919 million in the second quarter surpassed the Zacks Consensus Estimate of $10,776 million. The top line also grew 8% year over year. Organic revenues improved 6% on an annualized basis.

Segmental Break-Up

Revenues in the Aerospace segment came in at $4,058 million, up 10% year over year. The top-line performance of the Home and Building Technologies segment improved 5%, year over year, to $2,546 million. The Performance Materials and Technologies segment’s revenues in the second quarter came in at $2,698 million, up 5% year over year. The Safety and Productivity Solutions revenues improved 13%, year over year, to $1,617 million.

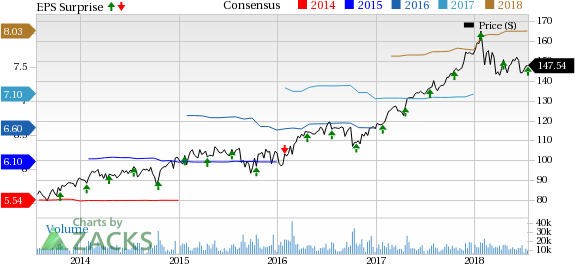

Honeywell International Inc. Price, Consensus and EPS Surprise

Honeywell International Inc. Price, Consensus and EPS Surprise | Honeywell International Inc. Quote

Costs/Margins

The company’s total cost of sales in the reported quarter was $7,613 million, up 8.4% year over year. Selling, general and administrative expenses came in at $1,528 million, up 4.9% year over year. Interest expenses and other financial charges were $95 million compared with $79 million witnessed in the comparable period last year.

Operating margin in the second quarter was 16.3%, up 40 basis points year over year.

Balance Sheet/Cash Flow

Exiting the quarter, Honeywell had cash and cash equivalents of $8,082 million, higher than $7,059 million recorded as of Dec 31, 2017. Long-term debt was $12,504 million, slightly lower than $12,573 million recorded at the end of 2017.

During the reported quarter, the company generated $1,861 million cash from operating activities, higher than $1,447 million recorded in the year-ago period. Capital expenditure in the April-June quarter was $199 million, lower than $233 million incurred in the year-earlier quarter.

Outlook

Concurrent with its earnings release, Honeywell revised the full-year earnings guidance for 2018. This Zacks Rank #2 (Buy) company anticipates to report earnings of $8.05-$8.15 per share in the current year, higher than the previous projection of $7.85-$8.05 per share.

The company is poised to grow on the back of strategic investments, greater operational efficacy and stronger demand for its diversified products.

Other Key Picks

Some other top-ranked stocks in the same space are listed below:

Hitachi Ltd. HTHIY sports a Zacks Rank of 1 (Strong Buy). The company’s earnings per share (EPS) are predicted to grow 13% in the next three to five years. You can see the complete list of today’s Zacks #1 Rank stocks here.

Raven Industries, Inc. RAVN also flaunts a Zacks Rank of 1. The company’s EPS will likely be up 10%, over the next three to five years.

Sumitomo Corp. SSUMY is another Zacks #1 Ranked company. Its EPS is projected to rise 5.50% during the same time frame.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honeywell International Inc. (HON) : Free Stock Analysis Report

Raven Industries, Inc. (RAVN) : Free Stock Analysis Report

Sumitomo Corp. (SSUMY) : Free Stock Analysis Report

Hitachi Ltd. (HTHIY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research