Can You Imagine How Héroux-Devtek's (TSE:HRX) Shareholders Feel About The 71% Share Price Increase?

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But if you pick the right individual stocks, you could make more than that. For example, the Héroux-Devtek Inc. (TSE:HRX) share price is up 71% in the last year, clearly besting the market return of around 26% (not including dividends). That's a solid performance by our standards! However, the longer term returns haven't been so impressive, with the stock up just 9.7% in the last three years.

Check out our latest analysis for Héroux-Devtek

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Héroux-Devtek grew its earnings per share, moving from a loss to a profit.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

Unfortunately Héroux-Devtek's fell 6.9% over twelve months. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

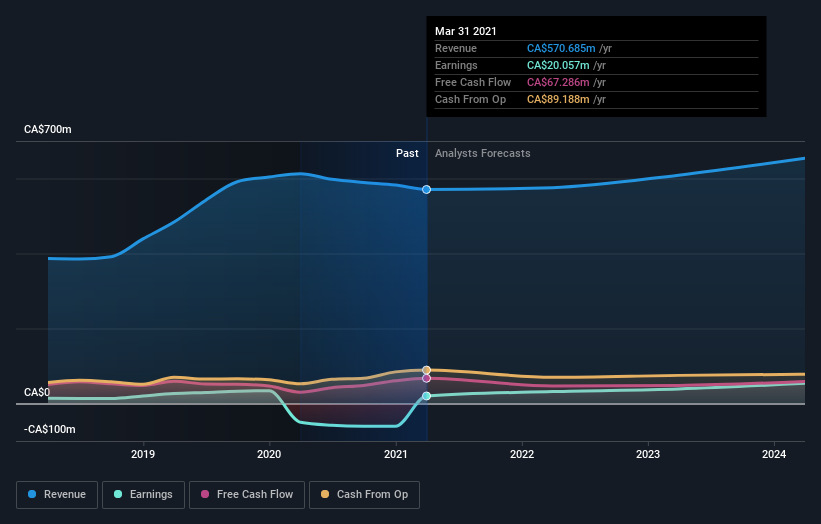

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that Héroux-Devtek has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Héroux-Devtek

A Different Perspective

We're pleased to report that Héroux-Devtek shareholders have received a total shareholder return of 71% over one year. That's better than the annualised return of 2% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Héroux-Devtek that you should be aware of.

Of course Héroux-Devtek may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.