Imagine Holding Michaels Companies (NASDAQ:MIK) Shares While The Price Zoomed 457% Higher

Active investing isn't easy, but for those that do it, the aim is to find the best companies to buy, and to profit handsomely. When you buy and hold the right company, the returns can make a huge difference to both you and your family. In the case of The Michaels Companies, Inc. (NASDAQ:MIK), the share price is up an incredible 457% in the last year alone. Also pleasing for shareholders was the 79% gain in the last three months. On the other hand, longer term shareholders have had a tougher run, with the stock falling 3.8% in three years.

See our latest analysis for Michaels Companies

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year, Michaels Companies actually saw its earnings per share drop 14%.

Given the share price gain, we doubt the market is measuring progress with EPS. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

Revenue was pretty flat year on year, but maybe a closer look at the data can explain the market optimism.

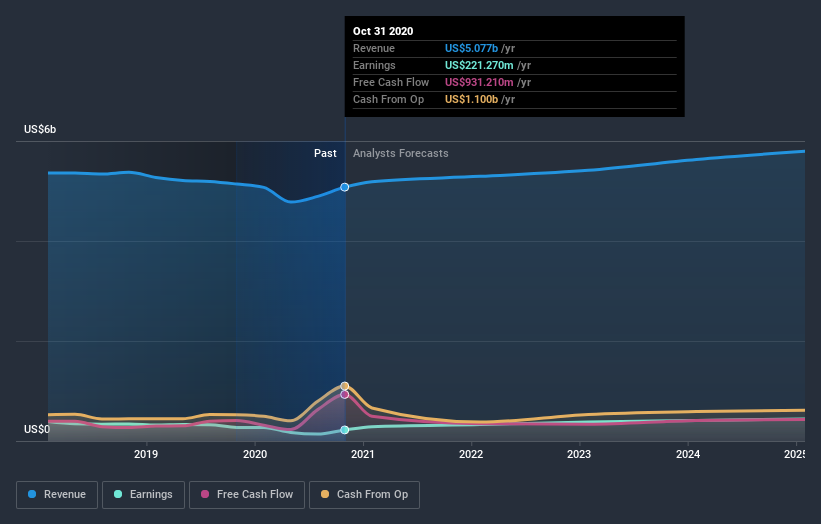

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that Michaels Companies shareholders have received a total shareholder return of 457% over one year. Notably the five-year annualised TSR loss of 2% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Michaels Companies better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Michaels Companies (of which 1 is a bit concerning!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.