Imagine Owning HUYA (NYSE:HUYA) And Wondering If The 20% Share Price Slide Is Justified

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

HUYA Inc. (NYSE:HUYA) shareholders should be happy to see the share price up 20% in the last month. But in truth the last year hasn't been good for the share price. The cold reality is that the stock has dropped 20% in one year, under-performing the market.

See our latest analysis for HUYA

Given that HUYA didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, HUYA increased its revenue by 107%. That's well above most other pre-profit companies. Given the revenue growth, the share price drop of 20% seems quite harsh. Our sympathies to shareholders who are now underwater. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

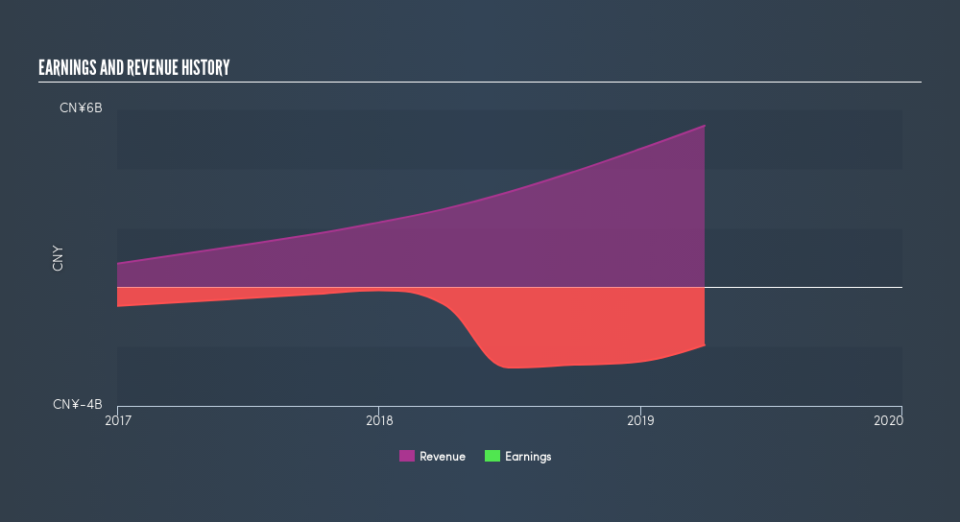

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

HUYA is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for HUYA in this interactive graph of future profit estimates.

A Different Perspective

Given that the market gained 6.6% in the last year, HUYA shareholders might be miffed that they lost 20%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 3.0% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.