Imagine Owning Shanghai Industrial Holdings (HKG:363) And Wondering If The 41% Share Price Slide Is Justified

Many investors define successful investing as beating the market average over the long term. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term Shanghai Industrial Holdings Limited (HKG:363) shareholders have had that experience, with the share price dropping 41% in three years, versus a market return of about 15%. Furthermore, it's down 13% in about a quarter. That's not much fun for holders.

Check out our latest analysis for Shanghai Industrial Holdings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate three years of share price decline, Shanghai Industrial Holdings actually saw its earnings per share (EPS) improve by 3.2% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

It's pretty reasonable to suspect the market was previously to bullish on the stock, and has since moderated expectations. But it's possible a look at other metrics will be enlightening.

Revenue is actually up 14% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Shanghai Industrial Holdings further; while we may be missing something on this analysis, there might also be an opportunity.

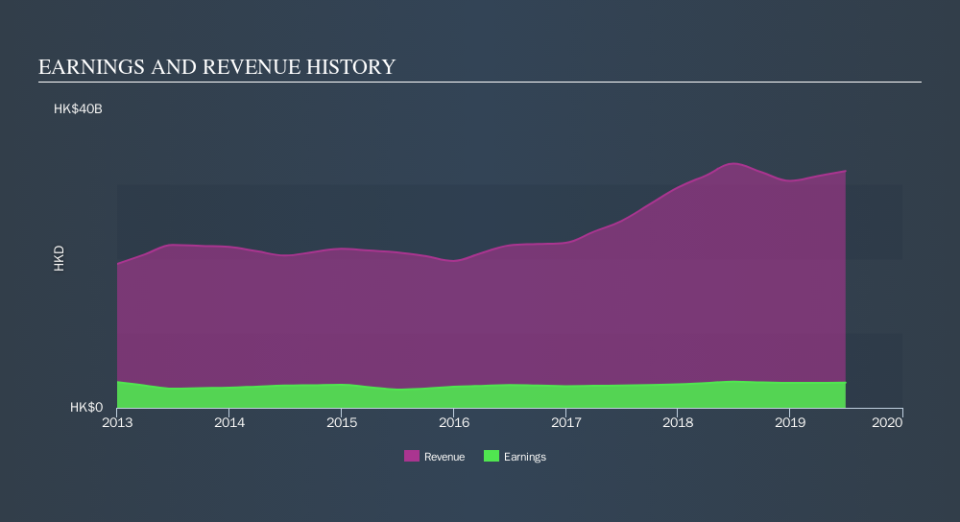

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free report showing analyst forecasts should help you form a view on Shanghai Industrial Holdings

What about the Total Shareholder Return (TSR)?

We've already covered Shanghai Industrial Holdings's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Shanghai Industrial Holdings's TSR of was a loss of 28% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Shanghai Industrial Holdings provided a TSR of 1.1% over the last twelve months. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 3.9% per year, over five years. So this might be a sign the business has turned its fortunes around. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.