Can You Imagine How W.W. Grainger's (NYSE:GWW) Shareholders Feel About The 41% Share Price Increase?

Vanguard founder Jack Bogle helped spearhead the low-cost index fund, putting average returns within reach of every investor. But if you pick the right individual stocks, you could make more than that. Notably, the W.W. Grainger, Inc. (NYSE:GWW) share price has gained 41% in three years, which is better than the average market return. More recently the stock has gained 7.1% in a year, which isn't too bad.

View our latest analysis for W.W. Grainger

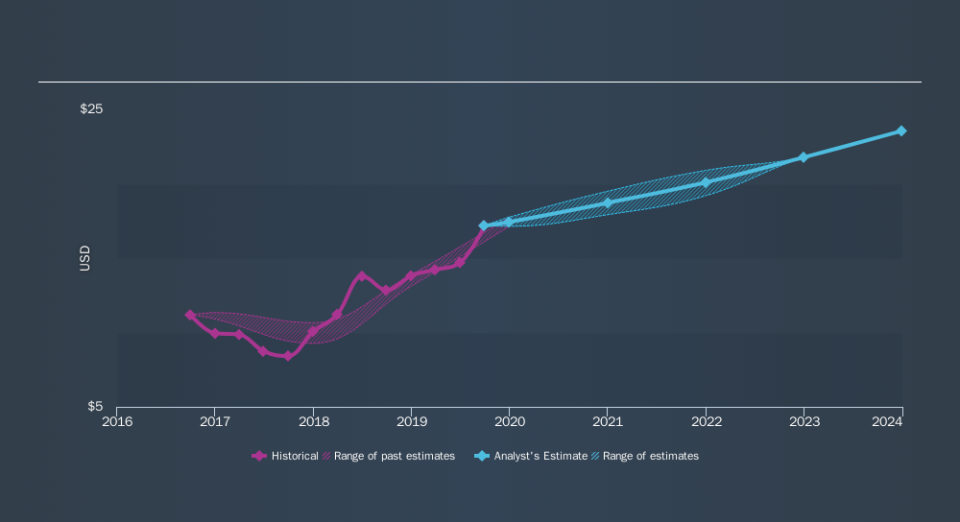

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

W.W. Grainger was able to grow its EPS at 15% per year over three years, sending the share price higher. The average annual share price increase of 12% is actually lower than the EPS growth. So one could reasonably conclude that the market has cooled on the stock.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that W.W. Grainger has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for W.W. Grainger the TSR over the last 3 years was 50%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

W.W. Grainger shareholders are up 9.2% for the year (even including dividends) . But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 7.6% per year over five year. This suggests the company might be improving over time. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.