Impinj's Growth Accelerates, but a Slowdown Is Coming

Radio-frequency identification solutions provider Impinj (NASDAQ: PI) reported its second-quarter results after the market closed on July 29. Revenue surged by more than 30% year over year, largely because of a very easy comparison. Impinj will begin to lap its post-inventory correction sales boost in the second half, and the company expects growth to slow down as a result.

Impinj results: The raw numbers

Metric | Q2 2019 | Q2 2018 | Year-Over-Year Change |

|---|---|---|---|

Revenue | $38.2 million | $28.5 million | 33.8% |

Net income | ($4.2 million) | ($7.7 million) | N/A |

Non-GAAP earnings per share | $0.03 | ($0.19) | N/A |

Data source: Impinj.

What happened with Impinj this quarter?

Impinj has now reported four consecutive quarters of year-over-year revenue growth following a period of steep declines resulting from partners' inventory corrections. Revenue growth accelerated from the first quarter.

Revenue from endpoint integrated circuits (ICs), which are used to track individual items, was $23.7 million, up 18.4% year over year. Revenue from systems was $14.5 million, up 70% year over year.

GAAP gross margin was 48.2%, while non-GAAP gross margin came in at 50%. Those compare with 48% and 50%, respectively, in the first quarter.

Adjusted earnings before interest, taxes, depreciation, and amortization was $0.8 million, up from a loss of $2.3 million in the first quarter.

GAAP operating expenses were $22.4 million, up just 5.4% year over year.

Impinj filed a patent infringement lawsuit against NXP Semiconductors in June related to 26 U.S. patents.

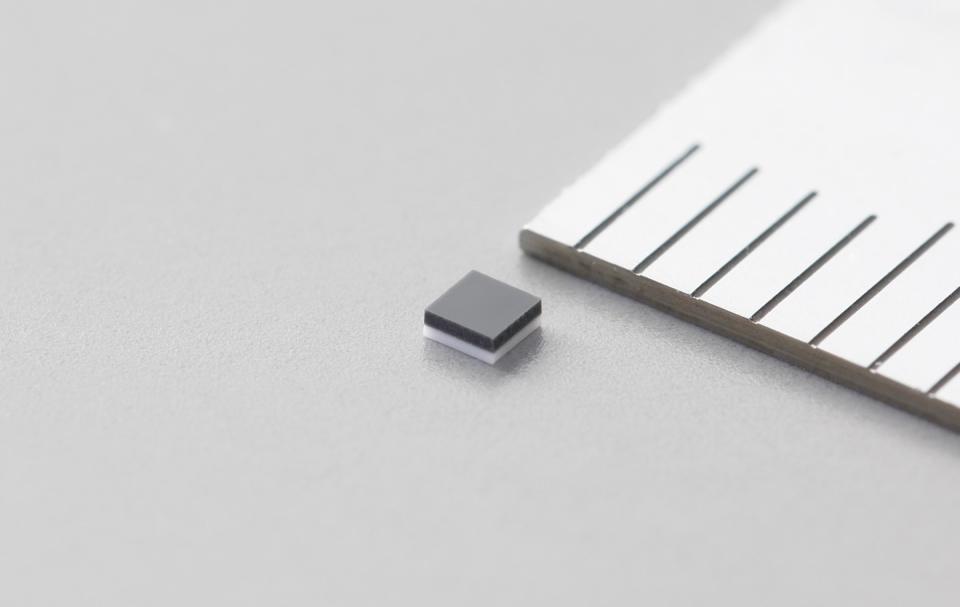

An Impinj RFID tag. Image source: Impinj.

What management had to say

Impinj CEO Chris Diorio gave an update on the M700 family of ICs during the earnings call: "Momentum continues building as our IC qualification and our partners' inlay in qualifications proceed in parallel. Those qualifications, our production timeline and end user adoption cycles mean the M700 family should begin favorably impacting our business next year."

Diorio also outlined the opportunity in the automotive industry:

We estimate the automotive industry uses more than 600 billion taggable parts per year and needs systems to read those tagged items all as part of Industry 4.0. It is too early to predict the timing of at-scale item level RAIN adoption in automotive, but the opportunity is huge and automotive is just one of many broad-based opportunities our partners are pursuing with the second example being aviation.

Diorio also discussed the patent lawsuit against NXP: "Our patents are the hard-earned fruits of our significant investment, dedication, and hard work, and we will defend them with firm determination, even as we continue innovating to further advance the RAIN market."

Looking forward

Impinj provided the following guidance for the third quarter:

Revenue between $37 million and $39 million, up 10.5% year over year at the midpoint.

Adjusted EBTIDA between a loss of $0.8 million and a profit of $0.8 million.

Non-GAAP net income per share between a loss of $0.04 and a profit of $0.03, compared with a loss of $0.05 in the prior-year period.

Impinj's revenue growth rate is set to slow in the third quarter as it fully laps the rise in sales following the inventory correction in 2017 and early 2018. The company sees channel inventory in a healthy position, so another correction doesn't look likely anytime soon.

More From The Motley Fool

Timothy Green has no position in any of the stocks mentioned. The Motley Fool recommends Impinj and NXP Semiconductors. The Motley Fool has a disclosure policy.