Industry Disruption in Health Care: Are Hospital Woes Seasonal or Structural?

By: Janus Henderson Investors

Harvest Exchange

January 9, 2018

Industry Disruption in Health Care: Are Hospital Woes Seasonal or Structural?

Key Takeaways

Low-cost care centers coupled with new approaches by managed-care organizations (MCOs) are encouraging consumers to take ownership of their health care.

While patients reap the benefits of these industry disruptions, hospitals may not be as lucky.

High yield spreads generally compressed in the latter half of 2017, as investors reaching for yield moved down in the quality spectrum. Spreads in high-yield health care, however, have widened since June. This is due primarily to hospitals, which represent a significant component of the high-yield health care index.

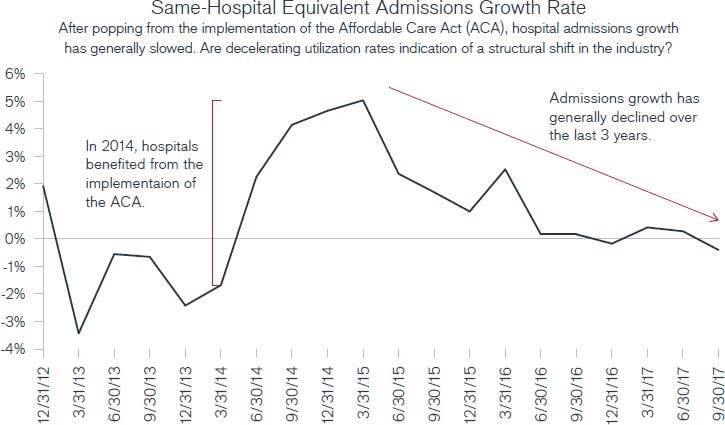

Hospitals have reported lower-than-expected earnings for 2017, a trend that is largely attributable to a decline in same-facility admission rates. Weak volumes pressure top-line growth, which creates challenges for hospitals due to their substantial fixed-costs and highly-levered nature. While many hospitals claim the decline in volume is merely seasonal, we believe a number of industry disruptions are in play that could have a long-term structural impact on hospital admissions, and therefore prolong the disappointing earnings trend.

For one, managed-care organizations (MCOs) are making strides in cost-effective health care solutions. While patients may be responsible for a greater portion of the bill – through large insurance copays and high-deductible plans – MCOs have effectively given the consumer skin in the game. Consumers are now provided with greater cost transparency for procedures and locations, incentivizing them to make economically responsible health care decisions. Further, many insurance providers offer free services for low-acuity/low-intensity needs, including telemedicine. If given the choice between braving the emergency room (ER) or inputting your symptoms online, then video conferencing with a doctor and having a prescription written from the comfort of your couch, which would you choose?

Hospitals are also contending with a surge in lower cost care facilities. Freestanding emergency departments, ambulatory service centers and urgent care facilities can meet a significant portion of patient needs, and escalating copays and deductibles are steering the price-conscious consumer toward these less costly options, when possible. Grocery and drug store clinics can also help with low-acuity diagnoses, leaving the hospital, more often than not, as the patient’s last resort. While this changes the payment mix in the ER to high-acuity, more expensive procedures, it is also leading to lower overall hospital admissions.

The industry did anticipate increased seasonality due to the January 1 reset of high deductibles. It was expected that commercially insured people would postpone elective procedures until later in the year, once those deductibles were nearly met. Yet as consumers take increased ownership of their health care, they appear to be thinking through both elective and emergency situations before heading to the hospital, and hospital volumes slowed throughout 2017. Placing control in the hands of the consumer and providing more cost-effective options could be destroying demand for traditional hospital services.

Given how quickly these trends are manifesting, we believe it is worth questioning if they will lead to a sustainable, structural shift in industry fundamentals. It is worth noting that many health care service companies are engaging in merger and acquisition activity to capitalize on the volume shift to lower-cost facilities. Additionally, an expanding population and aging demographic will continue to be supportive for hospital volumes. It remains to be seen, however, if it’s enough to offset these growing trends.

Source: Bloomberg, as of 12/2017

Originally Published at: Industry Disruption in Health Care: Are Hospital Woes Seasonal or Structural?